Xero

Xero

Cloud-based accounting software offering invoicing, bank reconciliation, payroll, project tracking, multi-currency support, and 1,000+ integrations for businesses.

Key Features

- Cloud-Based Accounting

- Bank Reconciliation & Bank Feeds

- Invoicing & Billing

- Expense Management & Receipt Capture

- Payroll Processing

- Multi-Currency Support

- Project Tracking & Time Management

- Inventory Management

- Purchase Orders

- Automated Bank Rules

- Real-Time Financial Reporting

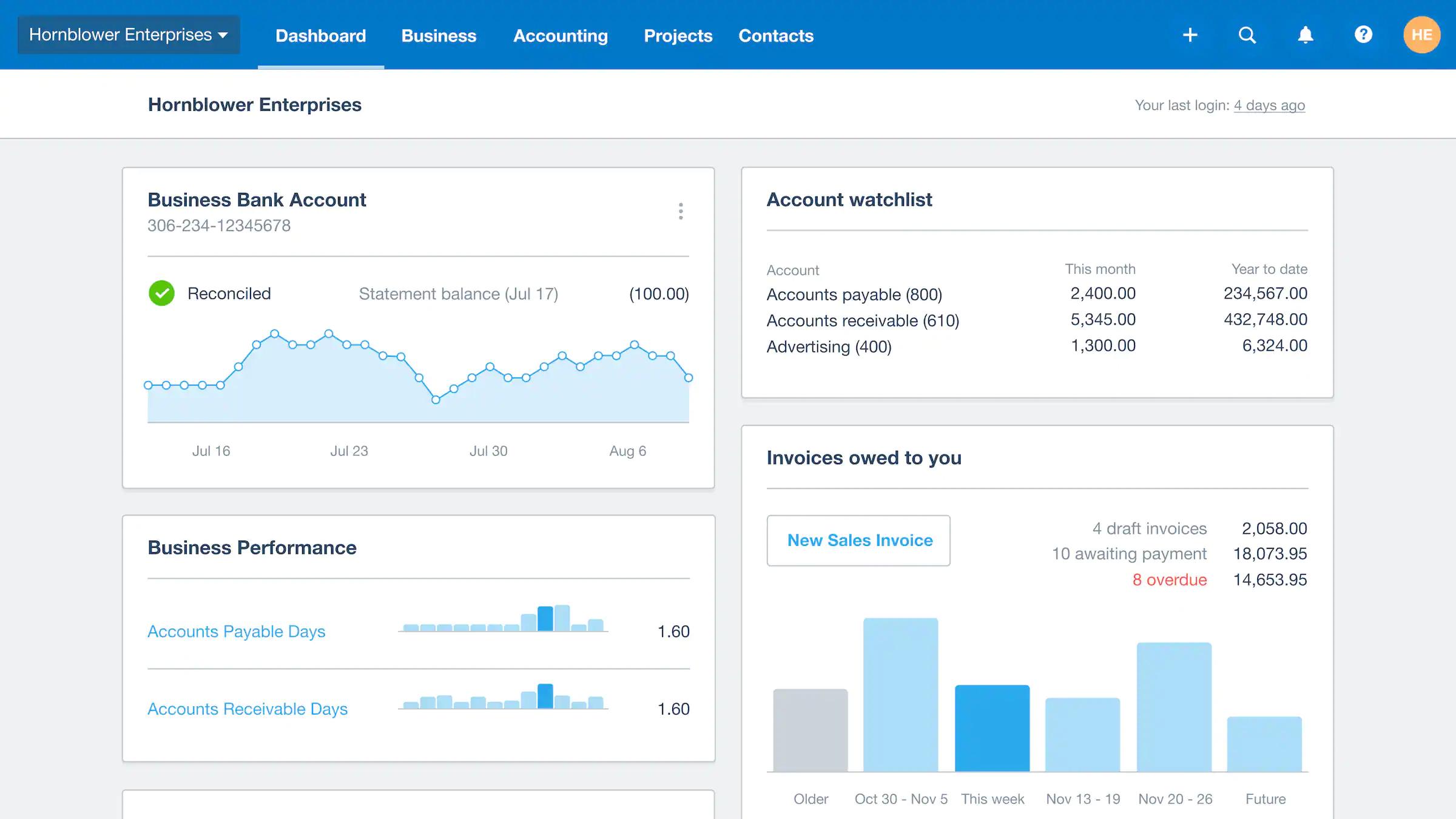

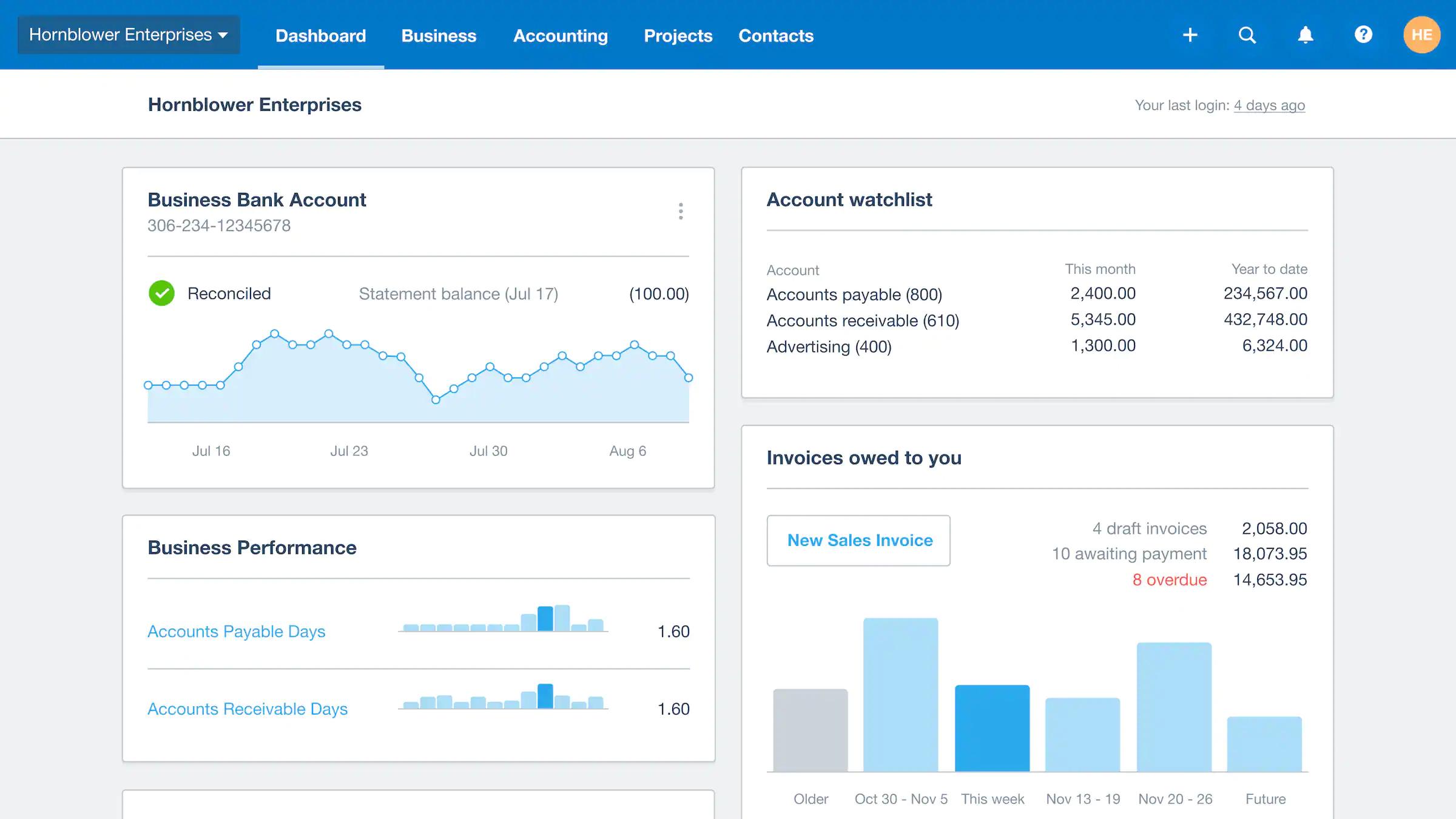

- Dashboard & Analytics

- Tax Compliance & Calculations

- Unlimited Users

- Document Management (Hubdoc)

- Custom Fields

- Workflow Automation

- Contact Management

- Bill Management

- Cash Flow Forecasting

- Budget Tracking

- Quote Generation

- Subscription Billing

- Financial Planning

- Audit Trail

- Role-Based Permissions

- Data Export

- Backup & Security

What is Xero?

Xero is a leading cloud-based accounting software platform that has revolutionized financial management for small to medium-sized businesses since its founding in 2006 by Rod Drury in New Zealand. With over 3.95 million subscribers globally and serving businesses in 180+ countries, Xero has established itself as a dominant force in the cloud accounting market, competing directly with established players like QuickBooks and Sage.

The platform operates on a "beautiful accounting software" philosophy, emphasizing user-friendly design, real-time collaboration, and accessibility from anywhere with an internet connection. Unlike traditional desktop accounting software, Xero stores all financial data securely in the cloud, enabling seamless access across devices and automatic updates without manual intervention.

What sets Xero apart is its comprehensive approach to business financial management. Beyond basic bookkeeping, the platform integrates invoicing, bank reconciliation, payroll, inventory management, project tracking, and multi-currency support into a unified ecosystem. This integration eliminates the need for multiple software solutions while ensuring data consistency across all business processes.

Xero's strength lies in its ability to automate routine accounting tasks while providing real-time financial insights that enable data-driven decision making. The platform's bank feed technology automatically imports and categorizes transactions, while its AI-powered features suggest account mappings and detect duplicates, significantly reducing manual work and human error.

Pros and Cons

Pros:

- Cloud-based accessibility enabling work from anywhere with internet connectivity and real-time collaboration

- Unlimited users on all plans, making it cost-effective for growing teams and collaborative environments

- Comprehensive automation features including bank reconciliation, invoice reminders, and automated reporting

- Extensive integration ecosystem with 1,000+ third-party applications through Xero App Store

- Strong multi-currency support with automatic exchange rate updates for international businesses

- User-friendly interface designed for non-accountants with minimal learning curve

- Real-time financial reporting and customizable dashboards for immediate business insights

- Robust security with SOC 2 Type 2, ISO 27001:2022 certifications and GDPR compliance

- Mobile apps with full feature parity and offline capabilities for field-based work

- Regular automatic updates with new features and security enhancements

Cons:

- Requires stable internet connection for full functionality; limited offline access capabilities

- Can experience performance issues with high-volume transactions (over 1,000 invoices/bills monthly)

- No dedicated phone support; customer service primarily through email and chat channels

- Limited advanced project management features compared to specialized tools

- Pricing can become expensive for businesses with multiple entities requiring separate subscriptions

- Some advanced features like multi-currency and inventory tracking require higher-tier plans

- Learning curve increases significantly for complex customizations and advanced workflows

- Limited built-in payroll in some regions, requiring third-party integrations like Wagepoint

Who It's For

Xero serves a diverse ecosystem of businesses across multiple industries and organizational sizes, with particular strength in serving growing companies that value collaboration and accessibility.

Small to Medium Businesses (2-500 employees): Xero excels for growing companies that need professional accounting capabilities without enterprise complexity. The platform's unlimited user access and scalable pricing make it particularly attractive for businesses expanding their teams and requiring collaborative financial management.

Service-Based Businesses and Consultancies: Professional services firms benefit from Xero's project tracking, time management, and client billing features. The platform's ability to track project profitability and generate detailed client reports makes it ideal for businesses billing by time or project.

E-commerce and Retail Businesses: Online retailers leverage Xero's inventory management, multi-currency support, and integrations with platforms like Shopify, WooCommerce, and Amazon. The platform's automated bank reconciliation particularly benefits businesses with high transaction volumes.

International and Multi-Currency Businesses: Companies operating across borders appreciate Xero's robust multi-currency support, automatic exchange rate updates, and ability to handle complex international transactions seamlessly.

Accounting Professionals and Bookkeepers: Over 200,000 accounting and bookkeeping partners use Xero to serve their clients, benefiting from features like client insights, practice management tools, and collaborative access that enables efficient client service delivery.

Construction and Project-Based Industries: Companies requiring detailed job costing, project tracking, and progress billing utilize Xero's project management features to monitor profitability by job and manage complex project financials.

Cloud-Based Accounting

Xero's cloud infrastructure provides secure, scalable access to financial data from any device with internet connectivity. The platform employs enterprise-grade security measures including AES-256 encryption for data at rest, TLS encryption for data in transit, and regular security audits to maintain SOC 2 Type 2 and ISO 27001:2022 certifications.

The cloud architecture enables real-time collaboration between business owners, accountants, and team members without version control issues or data synchronization problems. All users access the same live data, ensuring consistency and eliminating the confusion often associated with shared spreadsheets or desktop software.

Automatic updates and backups occur seamlessly in the background, ensuring users always have access to the latest features and security enhancements without manual intervention. The platform's multi-tenant architecture provides 99.99% uptime reliability while maintaining data isolation between different organizations.

Bank Reconciliation & Bank Feeds

Xero's bank feed technology connects to over 12,000 financial institutions globally, automatically importing transactions and maintaining real-time synchronization between bank accounts and accounting records. This automation dramatically reduces manual data entry while improving accuracy and timeliness of financial information.

The intelligent matching system uses machine learning to categorize transactions based on historical patterns and user preferences. Bank rules can be configured to automatically assign transactions to specific accounts, contacts, or projects, further streamlining the reconciliation process and ensuring consistent categorization.

Advanced reconciliation features include the ability to match multiple transactions to single entries, handle foreign exchange differences, and reconcile across different currencies. The system maintains complete audit trails and provides clear visibility into unreconciled transactions, enabling quick identification and resolution of discrepancies.

Invoicing & Billing

Xero's invoicing system delivers professional, customizable invoices with company branding, multiple template options, and flexible payment terms. The platform supports both one-time and recurring invoicing, with automated reminder systems that help improve cash flow by reducing overdue payments.

Payment integration with services like Stripe, PayPal, and GoCardless enables customers to pay directly from invoices, with payments automatically reconciled against outstanding receivables. The system tracks invoice status in real-time, showing when invoices are sent, viewed, and paid.

Multi-currency invoicing capabilities allow businesses to bill international customers in their preferred currencies while maintaining accurate exchange rate tracking and reporting. The platform automatically handles currency conversion and provides clear visibility into foreign exchange gains and losses.

Payroll Processing

Xero Payroll automates salary calculations, tax withholdings, and compliance reporting while supporting various pay structures including hourly, salaried, and commission-based compensation. The system handles direct deposits, printed paychecks, and provides employee self-service portals for accessing pay stubs and tax documents.

Tax compliance features automatically calculate federal, state, and local taxes while maintaining up-to-date tax tables and regulatory requirements. The platform can automatically file payroll taxes and generate required compliance reports, reducing administrative burden and ensuring accuracy.

In regions where native payroll isn't available, Xero integrates seamlessly with specialized payroll providers like Wagepoint (Canada), Gusto (US), and other regional solutions to provide comprehensive payroll management while maintaining data synchronization with the accounting system.

Project Tracking & Time Management

Xero's project management functionality enables businesses to track time, expenses, and profitability by job or client. The integrated time tracking system supports both manual entry and automatic timers, with mobile app capabilities for field-based time capture.

Project budgeting and profitability analysis provide real-time insights into project performance against budgets, enabling proactive management of project scope and resources. The system can generate detailed project reports showing time spent, expenses incurred, and overall project profitability.

Time tracking integrates seamlessly with invoicing, allowing businesses to bill clients for tracked time automatically while maintaining detailed records for project analysis and client reporting. This integration ensures accurate billing and provides valuable insights into resource utilization.

Multi-Currency Support

Xero's multi-currency functionality supports 160+ currencies with automatic exchange rate updates and comprehensive foreign exchange management. Businesses can invoice customers, pay suppliers, and maintain bank accounts in different currencies while ensuring accurate conversion and reporting.

The system automatically tracks foreign exchange gains and losses, providing clear visibility into currency exposure and its impact on financial performance. Multi-currency reporting enables businesses to view financial statements in their base currency while maintaining detailed records of foreign currency transactions.

Currency conversion features include the ability to set custom exchange rates for specific transactions, handle forward contracts, and manage currency hedging strategies. This flexibility supports complex international business operations while maintaining accurate financial records.

API & Integrations

Xero's comprehensive API enables custom integrations and workflow automation through platforms like Zapier, Make, and custom development. The RESTful API provides access to all major Xero functions including invoicing, contact management, financial data, and reporting.

Webhook support enables real-time notifications of changes in Xero, allowing external systems to respond immediately to events like payment receipts, invoice creation, or contact updates. This capability supports sophisticated business process automation and real-time data synchronization.

The Xero App Store features 1,000+ pre-built integrations spanning CRM, e-commerce, project management, payroll, and industry-specific applications. Popular integrations include Shopify for e-commerce, Stripe for payments, and HubSpot for customer relationship management.

Mobile Applications

Xero's mobile apps for iOS and Android provide full accounting functionality optimized for mobile devices, including invoice creation, expense capture, bank reconciliation, and financial reporting. The apps include unique mobile-specific features like receipt scanning with OCR, GPS-based mileage tracking, and voice note capabilities.

Offline functionality allows users to continue working when internet connectivity is limited, with automatic synchronization when connection is restored. This capability is particularly valuable for field-based businesses and remote workers who need reliable access to financial information.

Mobile security features include biometric authentication, device encryption, and remote wipe capabilities for lost or stolen devices. These features ensure that sensitive financial data remains protected while enabling mobile productivity.

Security and Compliance

Xero maintains enterprise-grade security with multiple compliance certifications including SOC 2 Type 2, ISO 27001:2022, and GDPR compliance. The platform employs advanced encryption, multi-factor authentication, and comprehensive audit logging to protect sensitive financial data.

Regular third-party security audits and penetration testing ensure ongoing protection against emerging threats. The platform's security infrastructure includes intrusion detection, DDoS protection, and 24/7 security monitoring by dedicated security professionals.

Data residency options enable organizations to choose where their data is stored and processed, supporting compliance with local data protection regulations. The platform provides detailed audit trails and supports various compliance frameworks required by regulated industries.

Pricing

Xero offers transparent pricing across multiple tiers designed to accommodate different business sizes and feature requirements, with pricing varying by geographic region.

United States Pricing:

- Early Plan: $15 per month (increasing to $20 from December 2024) - Supports 20 invoices, 5 bills monthly, basic reconciliation, and receipt capture

- Growing Plan: $47 per month - Includes unlimited invoices and bills, bulk reconciliation, and advanced features

- Established Plan: $80 per month - Adds multi-currency support, project tracking, expense claims, and analytics plus

International Pricing (varies by region):

- Australia: Ignite ($35 AUD), Grow ($70 AUD), Comprehensive ($90 AUD), Ultimate ($115 AUD)

- United Kingdom: Starter (£16), Standard (£33), Premium (£47), Ultimate (£59)

- Canada: Starter ($18 CAD), Standard ($45 CAD), Premium ($58 CAD)

Add-On Services:

- Xero Projects: Varies by plan, included in higher tiers

- Xero Expenses: Add-on pricing for expense management

- Payroll: Regional pricing varies, integrated in some plans

- Multiple Organizations: Discounts available for businesses managing multiple entities

All plans include unlimited users, automatic updates, mobile apps, and basic customer support. Higher-tier plans provide advanced reporting, premium support, and enterprise-grade features.

Verdict

Xero stands out as a comprehensive, user-friendly accounting platform that successfully balances powerful functionality with accessibility. Its greatest strength lies in democratizing professional accounting capabilities, making sophisticated financial management accessible to businesses regardless of their accounting expertise or technical resources.

The platform excels for growing businesses that value collaboration, real-time access to financial data, and integration with modern business tools. Xero's unlimited user access, extensive automation capabilities, and robust integration ecosystem provide significant competitive advantages over traditional accounting software, particularly for distributed teams and international operations.

However, organizations should carefully consider their specific requirements before committing to Xero. Businesses with very high transaction volumes, complex reporting needs, or requirements for extensive offline functionality may find limitations in Xero's cloud-first approach. Additionally, the pricing structure can become significant for businesses operating multiple entities or requiring extensive add-on services.

For the majority of small to medium-sized businesses, Xero represents an excellent investment in long-term financial management capabilities. The platform's continuous innovation in AI, automation, and user experience, combined with its strong security posture and global reach, positions it well for future business needs.

The recent emphasis on AI-powered features, enhanced project management, and deeper integrations demonstrates Xero's commitment to staying ahead of market trends while maintaining its core strength in accessible, powerful accounting software. Organizations prioritizing growth, collaboration, and operational efficiency will find Xero particularly valuable for their financial management needs.

Frequently Asked Questions about Xero

What is Xero?

Xero is a leading cloud-based accounting software platform that has revolutionized financial management for small to medium-sized businesses since its founding in 2006 by Rod Drury in New Zealand. With over 3.95 million subscribers globally and serving businesses in 180+ countries, Xero has established itself as a dominant force in the cloud accounting market, competing directly with established players like QuickBooks and Sage.

The platform operates on a "beautiful accounting software" philosophy, emphasizing user-friendly design, real-time collaboration, and accessibility from anywhere with an internet connection. Unlike traditional desktop accounting software, Xero stores all financial data securely in the cloud, enabling seamless access across devices and automatic updates without manual intervention.

What sets Xero apart is its comprehensive approach to business financial management. Beyond basic bookkeeping, the platform integrates invoicing, bank reconciliation, payroll, inventory management, project tracking, and multi-currency support into a unified ecosystem. This integration eliminates the need for multiple software solutions while ensuring data consistency across all business processes.

Xero's strength lies in its ability to automate routine accounting tasks while providing real-time financial insights that enable data-driven decision making. The platform's bank feed technology automatically imports and categorizes transactions, while its AI-powered features suggest account mappings and detect duplicates, significantly reducing manual work and human error.

Pros and Cons

Pros:

- Cloud-based accessibility enabling work from anywhere with internet connectivity and real-time collaboration

- Unlimited users on all plans, making it cost-effective for growing teams and collaborative environments

- Comprehensive automation features including bank reconciliation, invoice reminders, and automated reporting

- Extensive integration ecosystem with 1,000+ third-party applications through Xero App Store

- Strong multi-currency support with automatic exchange rate updates for international businesses

- User-friendly interface designed for non-accountants with minimal learning curve

- Real-time financial reporting and customizable dashboards for immediate business insights

- Robust security with SOC 2 Type 2, ISO 27001:2022 certifications and GDPR compliance

- Mobile apps with full feature parity and offline capabilities for field-based work

- Regular automatic updates with new features and security enhancements

Cons:

- Requires stable internet connection for full functionality; limited offline access capabilities

- Can experience performance issues with high-volume transactions (over 1,000 invoices/bills monthly)

- No dedicated phone support; customer service primarily through email and chat channels

- Limited advanced project management features compared to specialized tools

- Pricing can become expensive for businesses with multiple entities requiring separate subscriptions

- Some advanced features like multi-currency and inventory tracking require higher-tier plans

- Learning curve increases significantly for complex customizations and advanced workflows

- Limited built-in payroll in some regions, requiring third-party integrations like Wagepoint

Who It's For

Xero serves a diverse ecosystem of businesses across multiple industries and organizational sizes, with particular strength in serving growing companies that value collaboration and accessibility.

Small to Medium Businesses (2-500 employees): Xero excels for growing companies that need professional accounting capabilities without enterprise complexity. The platform's unlimited user access and scalable pricing make it particularly attractive for businesses expanding their teams and requiring collaborative financial management.

Service-Based Businesses and Consultancies: Professional services firms benefit from Xero's project tracking, time management, and client billing features. The platform's ability to track project profitability and generate detailed client reports makes it ideal for businesses billing by time or project.

E-commerce and Retail Businesses: Online retailers leverage Xero's inventory management, multi-currency support, and integrations with platforms like Shopify, WooCommerce, and Amazon. The platform's automated bank reconciliation particularly benefits businesses with high transaction volumes.

International and Multi-Currency Businesses: Companies operating across borders appreciate Xero's robust multi-currency support, automatic exchange rate updates, and ability to handle complex international transactions seamlessly.

Accounting Professionals and Bookkeepers: Over 200,000 accounting and bookkeeping partners use Xero to serve their clients, benefiting from features like client insights, practice management tools, and collaborative access that enables efficient client service delivery.

Construction and Project-Based Industries: Companies requiring detailed job costing, project tracking, and progress billing utilize Xero's project management features to monitor profitability by job and manage complex project financials.

Cloud-Based Accounting

Xero's cloud infrastructure provides secure, scalable access to financial data from any device with internet connectivity. The platform employs enterprise-grade security measures including AES-256 encryption for data at rest, TLS encryption for data in transit, and regular security audits to maintain SOC 2 Type 2 and ISO 27001:2022 certifications.

The cloud architecture enables real-time collaboration between business owners, accountants, and team members without version control issues or data synchronization problems. All users access the same live data, ensuring consistency and eliminating the confusion often associated with shared spreadsheets or desktop software.

Automatic updates and backups occur seamlessly in the background, ensuring users always have access to the latest features and security enhancements without manual intervention. The platform's multi-tenant architecture provides 99.99% uptime reliability while maintaining data isolation between different organizations.

Bank Reconciliation & Bank Feeds

Xero's bank feed technology connects to over 12,000 financial institutions globally, automatically importing transactions and maintaining real-time synchronization between bank accounts and accounting records. This automation dramatically reduces manual data entry while improving accuracy and timeliness of financial information.

The intelligent matching system uses machine learning to categorize transactions based on historical patterns and user preferences. Bank rules can be configured to automatically assign transactions to specific accounts, contacts, or projects, further streamlining the reconciliation process and ensuring consistent categorization.

Advanced reconciliation features include the ability to match multiple transactions to single entries, handle foreign exchange differences, and reconcile across different currencies. The system maintains complete audit trails and provides clear visibility into unreconciled transactions, enabling quick identification and resolution of discrepancies.

Invoicing & Billing

Xero's invoicing system delivers professional, customizable invoices with company branding, multiple template options, and flexible payment terms. The platform supports both one-time and recurring invoicing, with automated reminder systems that help improve cash flow by reducing overdue payments.

Payment integration with services like Stripe, PayPal, and GoCardless enables customers to pay directly from invoices, with payments automatically reconciled against outstanding receivables. The system tracks invoice status in real-time, showing when invoices are sent, viewed, and paid.

Multi-currency invoicing capabilities allow businesses to bill international customers in their preferred currencies while maintaining accurate exchange rate tracking and reporting. The platform automatically handles currency conversion and provides clear visibility into foreign exchange gains and losses.

Payroll Processing

Xero Payroll automates salary calculations, tax withholdings, and compliance reporting while supporting various pay structures including hourly, salaried, and commission-based compensation. The system handles direct deposits, printed paychecks, and provides employee self-service portals for accessing pay stubs and tax documents.

Tax compliance features automatically calculate federal, state, and local taxes while maintaining up-to-date tax tables and regulatory requirements. The platform can automatically file payroll taxes and generate required compliance reports, reducing administrative burden and ensuring accuracy.

In regions where native payroll isn't available, Xero integrates seamlessly with specialized payroll providers like Wagepoint (Canada), Gusto (US), and other regional solutions to provide comprehensive payroll management while maintaining data synchronization with the accounting system.

Project Tracking & Time Management

Xero's project management functionality enables businesses to track time, expenses, and profitability by job or client. The integrated time tracking system supports both manual entry and automatic timers, with mobile app capabilities for field-based time capture.

Project budgeting and profitability analysis provide real-time insights into project performance against budgets, enabling proactive management of project scope and resources. The system can generate detailed project reports showing time spent, expenses incurred, and overall project profitability.

Time tracking integrates seamlessly with invoicing, allowing businesses to bill clients for tracked time automatically while maintaining detailed records for project analysis and client reporting. This integration ensures accurate billing and provides valuable insights into resource utilization.

Multi-Currency Support

Xero's multi-currency functionality supports 160+ currencies with automatic exchange rate updates and comprehensive foreign exchange management. Businesses can invoice customers, pay suppliers, and maintain bank accounts in different currencies while ensuring accurate conversion and reporting.

The system automatically tracks foreign exchange gains and losses, providing clear visibility into currency exposure and its impact on financial performance. Multi-currency reporting enables businesses to view financial statements in their base currency while maintaining detailed records of foreign currency transactions.

Currency conversion features include the ability to set custom exchange rates for specific transactions, handle forward contracts, and manage currency hedging strategies. This flexibility supports complex international business operations while maintaining accurate financial records.

API & Integrations

Xero's comprehensive API enables custom integrations and workflow automation through platforms like Zapier, Make, and custom development. The RESTful API provides access to all major Xero functions including invoicing, contact management, financial data, and reporting.

Webhook support enables real-time notifications of changes in Xero, allowing external systems to respond immediately to events like payment receipts, invoice creation, or contact updates. This capability supports sophisticated business process automation and real-time data synchronization.

The Xero App Store features 1,000+ pre-built integrations spanning CRM, e-commerce, project management, payroll, and industry-specific applications. Popular integrations include Shopify for e-commerce, Stripe for payments, and HubSpot for customer relationship management.

Mobile Applications

Xero's mobile apps for iOS and Android provide full accounting functionality optimized for mobile devices, including invoice creation, expense capture, bank reconciliation, and financial reporting. The apps include unique mobile-specific features like receipt scanning with OCR, GPS-based mileage tracking, and voice note capabilities.

Offline functionality allows users to continue working when internet connectivity is limited, with automatic synchronization when connection is restored. This capability is particularly valuable for field-based businesses and remote workers who need reliable access to financial information.

Mobile security features include biometric authentication, device encryption, and remote wipe capabilities for lost or stolen devices. These features ensure that sensitive financial data remains protected while enabling mobile productivity.

Security and Compliance

Xero maintains enterprise-grade security with multiple compliance certifications including SOC 2 Type 2, ISO 27001:2022, and GDPR compliance. The platform employs advanced encryption, multi-factor authentication, and comprehensive audit logging to protect sensitive financial data.

Regular third-party security audits and penetration testing ensure ongoing protection against emerging threats. The platform's security infrastructure includes intrusion detection, DDoS protection, and 24/7 security monitoring by dedicated security professionals.

Data residency options enable organizations to choose where their data is stored and processed, supporting compliance with local data protection regulations. The platform provides detailed audit trails and supports various compliance frameworks required by regulated industries.

Pricing

Xero offers transparent pricing across multiple tiers designed to accommodate different business sizes and feature requirements, with pricing varying by geographic region.

United States Pricing:

- Early Plan: $15 per month (increasing to $20 from December 2024) - Supports 20 invoices, 5 bills monthly, basic reconciliation, and receipt capture

- Growing Plan: $47 per month - Includes unlimited invoices and bills, bulk reconciliation, and advanced features

- Established Plan: $80 per month - Adds multi-currency support, project tracking, expense claims, and analytics plus

International Pricing (varies by region):

- Australia: Ignite ($35 AUD), Grow ($70 AUD), Comprehensive ($90 AUD), Ultimate ($115 AUD)

- United Kingdom: Starter (£16), Standard (£33), Premium (£47), Ultimate (£59)

- Canada: Starter ($18 CAD), Standard ($45 CAD), Premium ($58 CAD)

Add-On Services:

- Xero Projects: Varies by plan, included in higher tiers

- Xero Expenses: Add-on pricing for expense management

- Payroll: Regional pricing varies, integrated in some plans

- Multiple Organizations: Discounts available for businesses managing multiple entities

All plans include unlimited users, automatic updates, mobile apps, and basic customer support. Higher-tier plans provide advanced reporting, premium support, and enterprise-grade features.

Verdict

Xero stands out as a comprehensive, user-friendly accounting platform that successfully balances powerful functionality with accessibility. Its greatest strength lies in democratizing professional accounting capabilities, making sophisticated financial management accessible to businesses regardless of their accounting expertise or technical resources.

The platform excels for growing businesses that value collaboration, real-time access to financial data, and integration with modern business tools. Xero's unlimited user access, extensive automation capabilities, and robust integration ecosystem provide significant competitive advantages over traditional accounting software, particularly for distributed teams and international operations.

However, organizations should carefully consider their specific requirements before committing to Xero. Businesses with very high transaction volumes, complex reporting needs, or requirements for extensive offline functionality may find limitations in Xero's cloud-first approach. Additionally, the pricing structure can become significant for businesses operating multiple entities or requiring extensive add-on services.

For the majority of small to medium-sized businesses, Xero represents an excellent investment in long-term financial management capabilities. The platform's continuous innovation in AI, automation, and user experience, combined with its strong security posture and global reach, positions it well for future business needs.

The recent emphasis on AI-powered features, enhanced project management, and deeper integrations demonstrates Xero's commitment to staying ahead of market trends while maintaining its core strength in accessible, powerful accounting software. Organizations prioritizing growth, collaboration, and operational efficiency will find Xero particularly valuable for their financial management needs.