Square

Square

Unified payments and business management platform with POS hardware, online store, invoicing, appointments, and payroll—flat-rate pricing, no monthly fee for core features.

Key Features

- In-Person Payments

- Online Checkout

- Virtual Terminal

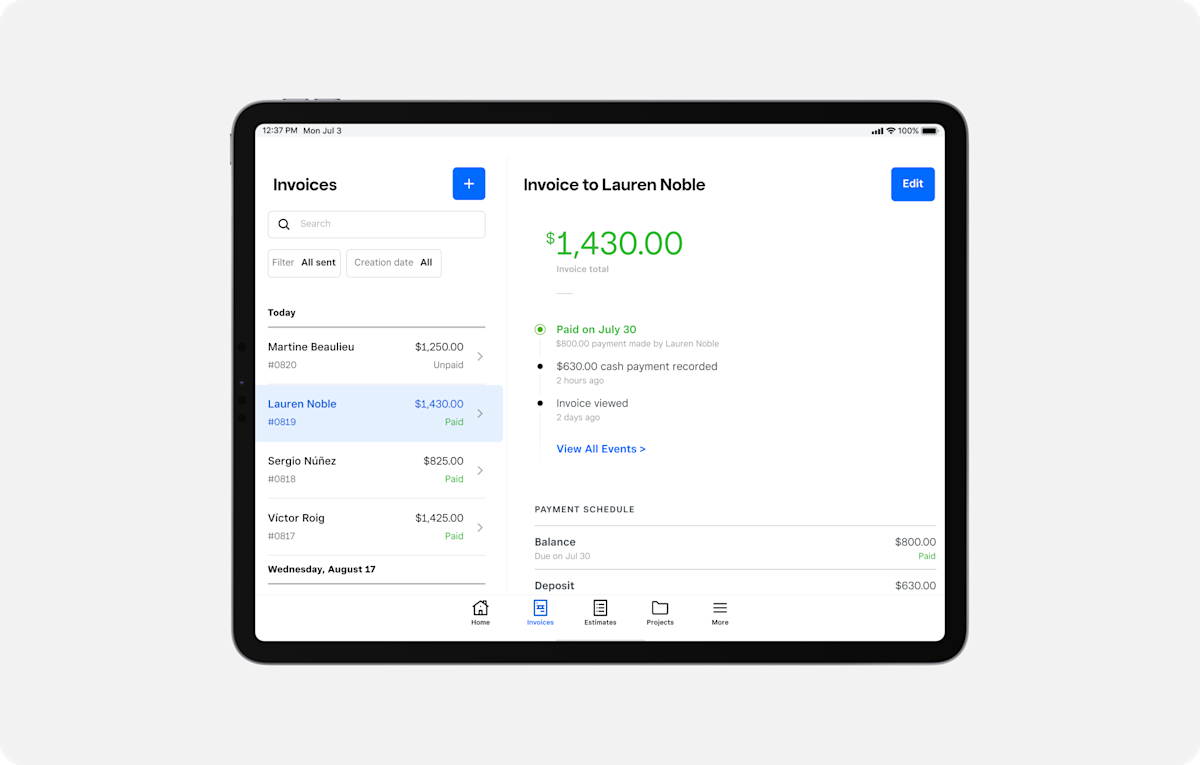

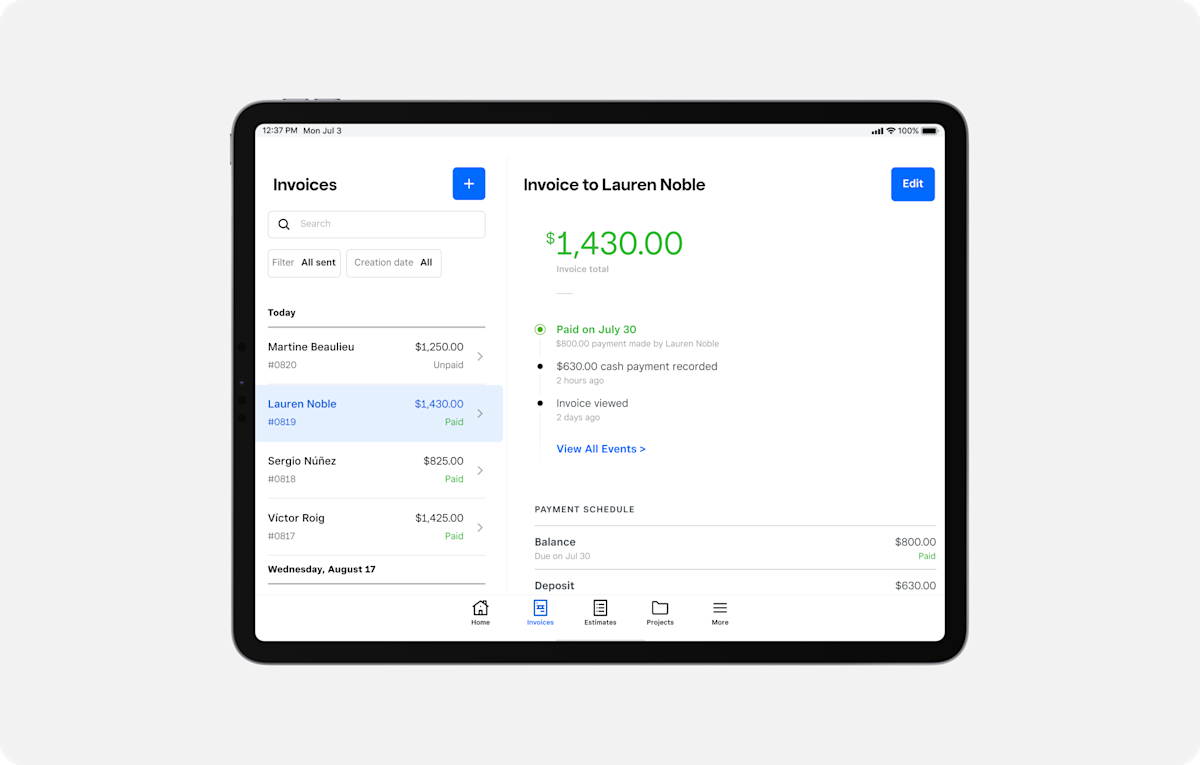

- Invoicing & Estimates

- Recurring Billing

- Appointments & Scheduling

- Payroll & Team Management

- Retail POS Features

- Restaurant POS Features

- Analytics & Reporting

- Instant Transfers

- Offline Payments

- Dispute Management

- Fraud Prevention

- Gift Cards & Loyalty

- Marketing & Email Campaigns

What Is Square?

Square is a cloud-based payments and business toolkit that powers transactions both offline and online. Launched in 2009 by Block, Inc., Square combines point-of-sale hardware (Reader, Stand, Register, Terminal) with software for e-commerce, invoicing, appointments, payroll, marketing, and financing. Merchants benefit from a unified dashboard, instant deposits, and seamless integrations to run and grow their businesses.

Pros and Cons

Pros

- Flat-rate processing with no hidden fees and free core POS

- Rapid setup on mobile devices or countertop hardware

- Wide range of tools (invoicing, appointments, payroll, lending) in one ecosystem

- Transparent dispute management, fraud prevention, and PCI compliance

- Extensible via APIs, Zapier, and Make for custom workflows

Cons

- Subscription required for advanced Retail, Restaurants, Appointments, and Online Store features

- Processing fees on all transactions, even with free plan

- Some advanced modules (Payroll, Marketing) carry additional monthly costs

- Offline payment reliability limited to 24-hour sessions

Who It’s For

Square serves:

- Retailers needing inventory, barcode scanning, and customer management

- Restaurants requiring order routing, kitchen display, and table management

- Service Providers using appointments, booking reminders, and prepayments

- Freelancers & Consultants invoicing clients and accepting card payments remotely

- Small Businesses seeking an integrated suite of payments, payroll, and marketing

In-Person Payments

Accept chip, tap, and swipe card transactions at 2.6% + 10¢ per in-person sale. Use Square Reader on mobile or deploy Square Stand/Register/Terminal at your counter.

Online Checkout

Sell on your website or via email and social posts with 2.9% + 30¢ per online transaction. Use Square Online Store or embed Checkout links and APIs.

Virtual Terminal

Manually key in payments via browser or mobile at 3.5% + 15¢ per transaction, ideal for phone-order, mail-order, or invoices.

Invoicing & Estimates

Create and send digital estimates and invoices. Accept card or ACH payments on invoices at 2.9% + 30¢ per card sale or 1% (max $10) per ACH payment.

Recurring Billing

Automate subscription or membership charges with custom billing schedules and automated payment retries.

Appointments & Scheduling

Manage bookings, staff calendars, reminders, and prepayments. Free for individuals; Plus at $29 /mo per location; Premium at $69 /mo per location.

Payroll & Team Management

Process payroll starting at $35 /mo plus $6 /employee; contractor-only option at $5 /contractor; integrate timecards and tax filing.

Retail POS Features

Free core Retail POS; Plus at $89 /mo per location; Premium custom pricing. Includes inventory management, purchase orders, purchase returns, and advanced reporting.

Restaurant POS Features

Free Restaurants software; Plus at $69 /mo per location (first device free, $40 per additional); Premium custom pricing. Adds floor plans, seat and course management, and 24/7 support.

Analytics & Reporting

Access real-time sales dashboards, item-level analytics, labor cost reports, and custom exports to optimize operations.

Instant Transfers

Move funds to your bank instantly for 1.5% per transfer or next-business-day free transfers.

Offline Payments

Continue accepting payments offline for up to 24 hours; transactions auto-process on reconnection.

Dispute Management & Fraud Prevention

Square handles chargebacks at no extra cost and employs proprietary risk modeling to flag suspicious transactions.

Pricing

Core POS and Payments:

- No monthly fee. Pay processing only:

- In-Person: 2.6% + 10¢

- Online: 2.9% + 30¢

- Invoices: 3.3% + 30¢

- Manual: 3.5% + 15¢.

Subscription Plans (per location/month):

- Square for Retail: Free; Plus $89; Premium custom.

- Square for Restaurants: Free; Plus $69; Premium custom.

- Square Appointments: Free; Plus $29; Premium $69.

- Square Online Store: Free; Plus $36; Premium $99.

Add-Ons: Payroll ($35 + $6 /employee); Marketing from $15 /mo; Lending via Square Loans (variable fees).

Verdict

Square delivers a versatile, easy-to-use ecosystem for merchants of all kinds. Its free basic POS and transparent rates lower barriers to entry, while modular subscriptions unlock advanced retail, restaurant, and appointment features. Strong integrations and developer APIs enable extensive customization. Organizations should weigh subscription costs for advanced functionality against transaction-only fees for core needs.

Frequently Asked Questions about Square

What Is Square?

Square is a cloud-based payments and business toolkit that powers transactions both offline and online. Launched in 2009 by Block, Inc., Square combines point-of-sale hardware (Reader, Stand, Register, Terminal) with software for e-commerce, invoicing, appointments, payroll, marketing, and financing. Merchants benefit from a unified dashboard, instant deposits, and seamless integrations to run and grow their businesses.

Pros and Cons

Pros

- Flat-rate processing with no hidden fees and free core POS

- Rapid setup on mobile devices or countertop hardware

- Wide range of tools (invoicing, appointments, payroll, lending) in one ecosystem

- Transparent dispute management, fraud prevention, and PCI compliance

- Extensible via APIs, Zapier, and Make for custom workflows

Cons

- Subscription required for advanced Retail, Restaurants, Appointments, and Online Store features

- Processing fees on all transactions, even with free plan

- Some advanced modules (Payroll, Marketing) carry additional monthly costs

- Offline payment reliability limited to 24-hour sessions

Who It’s For

Square serves:

- Retailers needing inventory, barcode scanning, and customer management

- Restaurants requiring order routing, kitchen display, and table management

- Service Providers using appointments, booking reminders, and prepayments

- Freelancers & Consultants invoicing clients and accepting card payments remotely

- Small Businesses seeking an integrated suite of payments, payroll, and marketing

In-Person Payments

Accept chip, tap, and swipe card transactions at 2.6% + 10¢ per in-person sale. Use Square Reader on mobile or deploy Square Stand/Register/Terminal at your counter.

Online Checkout

Sell on your website or via email and social posts with 2.9% + 30¢ per online transaction. Use Square Online Store or embed Checkout links and APIs.

Virtual Terminal

Manually key in payments via browser or mobile at 3.5% + 15¢ per transaction, ideal for phone-order, mail-order, or invoices.

Invoicing & Estimates

Create and send digital estimates and invoices. Accept card or ACH payments on invoices at 2.9% + 30¢ per card sale or 1% (max $10) per ACH payment.

Recurring Billing

Automate subscription or membership charges with custom billing schedules and automated payment retries.

Appointments & Scheduling

Manage bookings, staff calendars, reminders, and prepayments. Free for individuals; Plus at $29 /mo per location; Premium at $69 /mo per location.

Payroll & Team Management

Process payroll starting at $35 /mo plus $6 /employee; contractor-only option at $5 /contractor; integrate timecards and tax filing.

Retail POS Features

Free core Retail POS; Plus at $89 /mo per location; Premium custom pricing. Includes inventory management, purchase orders, purchase returns, and advanced reporting.

Restaurant POS Features

Free Restaurants software; Plus at $69 /mo per location (first device free, $40 per additional); Premium custom pricing. Adds floor plans, seat and course management, and 24/7 support.

Analytics & Reporting

Access real-time sales dashboards, item-level analytics, labor cost reports, and custom exports to optimize operations.

Instant Transfers

Move funds to your bank instantly for 1.5% per transfer or next-business-day free transfers.

Offline Payments

Continue accepting payments offline for up to 24 hours; transactions auto-process on reconnection.

Dispute Management & Fraud Prevention

Square handles chargebacks at no extra cost and employs proprietary risk modeling to flag suspicious transactions.

Pricing

Core POS and Payments:

- No monthly fee. Pay processing only:

- In-Person: 2.6% + 10¢

- Online: 2.9% + 30¢

- Invoices: 3.3% + 30¢

- Manual: 3.5% + 15¢.

Subscription Plans (per location/month):

- Square for Retail: Free; Plus $89; Premium custom.

- Square for Restaurants: Free; Plus $69; Premium custom.

- Square Appointments: Free; Plus $29; Premium $69.

- Square Online Store: Free; Plus $36; Premium $99.

Add-Ons: Payroll ($35 + $6 /employee); Marketing from $15 /mo; Lending via Square Loans (variable fees).

Verdict

Square delivers a versatile, easy-to-use ecosystem for merchants of all kinds. Its free basic POS and transparent rates lower barriers to entry, while modular subscriptions unlock advanced retail, restaurant, and appointment features. Strong integrations and developer APIs enable extensive customization. Organizations should weigh subscription costs for advanced functionality against transaction-only fees for core needs.