Stripe

Stripe

Complete payment infrastructure platform with APIs for online transactions, subscriptions, fraud prevention, and financial services for businesses worldwide.

Key Features

- Payment Processing

- Online Checkout

- Subscription Management

- Invoicing

- Payment Links

- Fraud Prevention (Radar)

- Mobile Payments

- In-Person Payments (Terminal)

- Connect Platform

- Billing Automation

- Tax Calculation

- Revenue Recognition

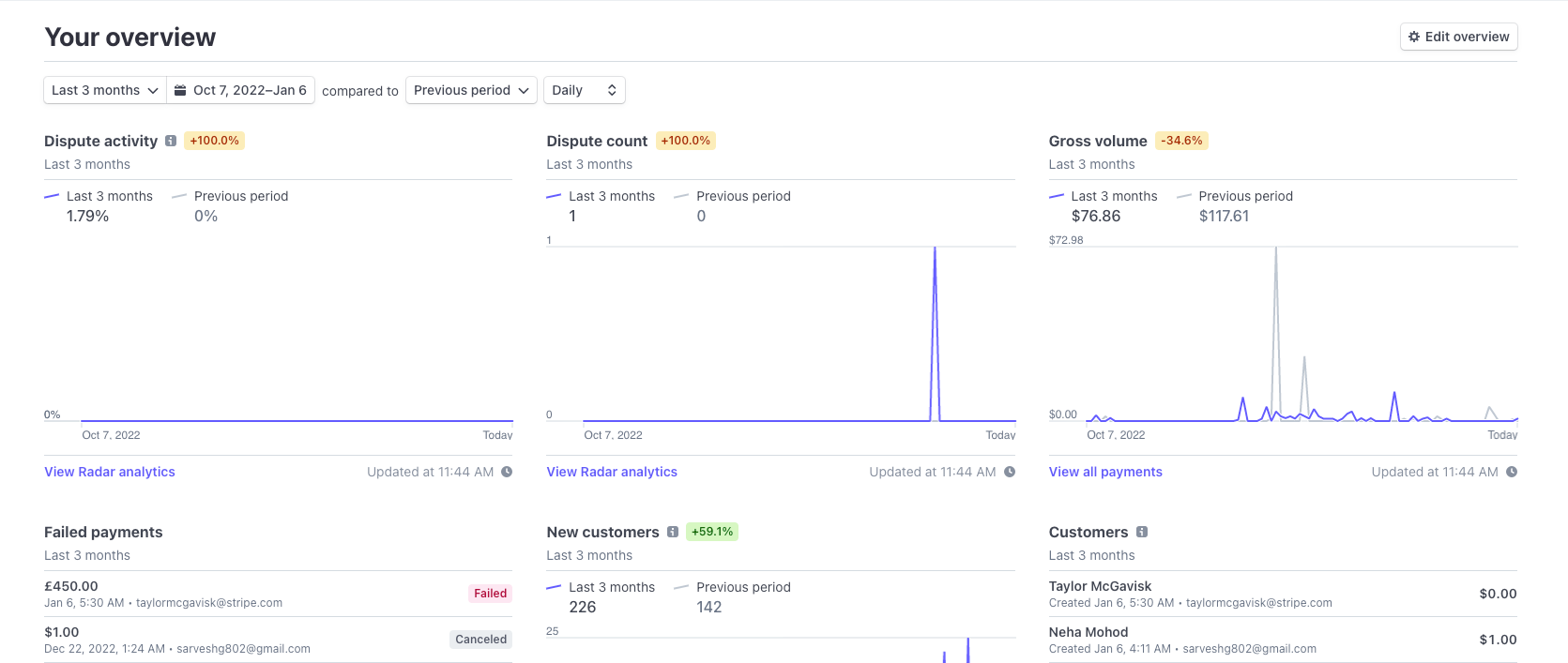

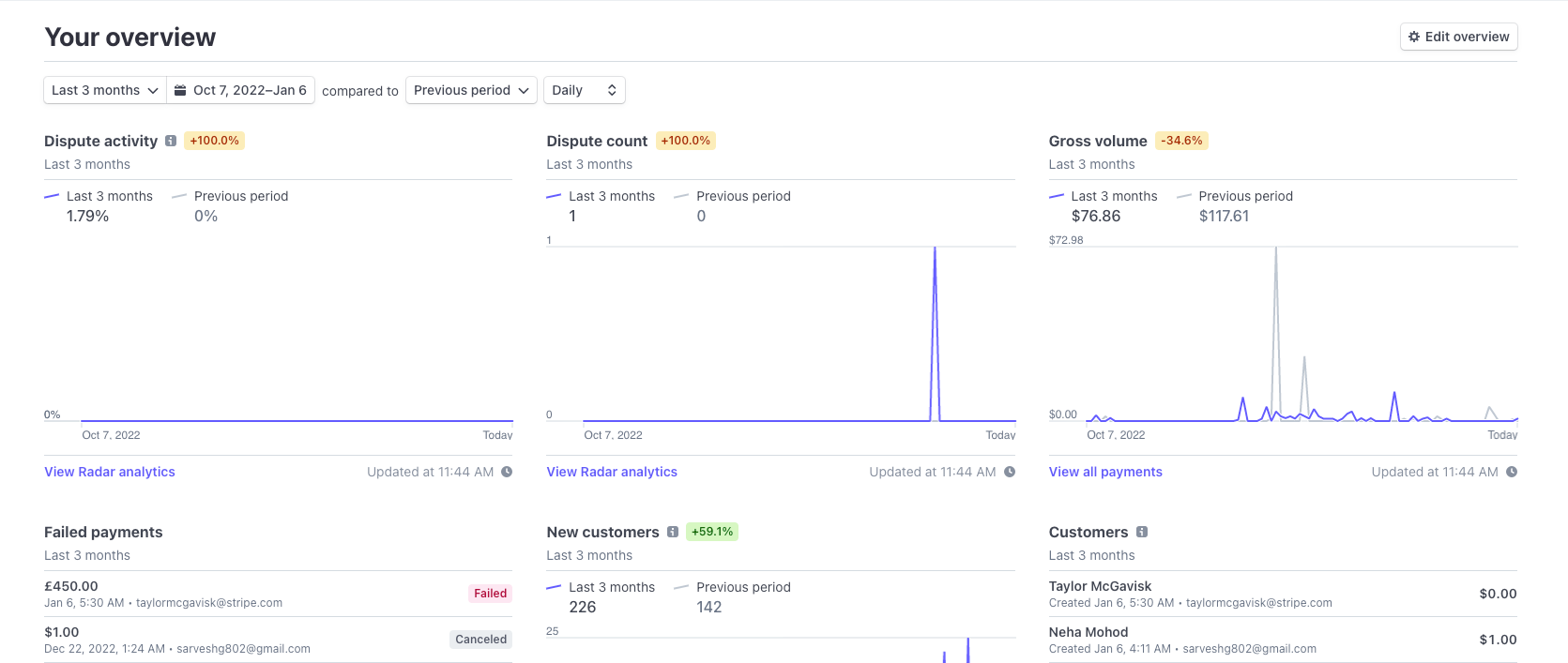

- Dashboard & Analytics

- Global Payment Methods

- Multi-Currency Support

- Developer Tools

- Customer Portal

- Dispute Management

- Instant Payouts

- ACH & Bank Transfers

- Identity Verification

- Treasury Services

- Issuing (Virtual Cards)

- Issuing (Virtual Cards)

- Issuing (Virtual Cards)

- Link (One-Click Checkout)

- Adaptive Acceptance

What is Stripe?

Stripe is the world's leading payment infrastructure platform that powers online commerce for millions of businesses globally. Founded in 2010 by Irish entrepreneurs Patrick and John Collison, Stripe has revolutionized digital payments by providing a comprehensive suite of APIs and tools that enable businesses to accept payments, manage subscriptions, send payouts, and handle complex financial operations seamlessly.

The platform serves as the financial backbone for companies ranging from early-stage startups to Fortune 500 enterprises, processing over $1 trillion in annual payment volume. Stripe's mission is to increase the GDP of the internet by providing the economic infrastructure that enables businesses to start, scale, and thrive in the digital economy.

What distinguishes Stripe from traditional payment processors is its developer-first approach and comprehensive platform architecture. Rather than simply processing credit card transactions, Stripe offers a complete financial operating system that includes payment processing, subscription billing, marketplace facilitation, fraud prevention, tax compliance, and banking services. This unified approach eliminates the need for businesses to integrate multiple vendors, reducing complexity and accelerating time to market.

Pros and Cons

Pros:

- Comprehensive payment infrastructure with 100+ payment methods and global reach to 195+ countries

- Developer-friendly APIs and extensive documentation with powerful customization capabilities

- Advanced fraud prevention through machine learning-powered Radar system

- Transparent pricing with no setup fees, monthly fees, or hidden costs

- Excellent uptime and reliability with enterprise-grade infrastructure

- Extensive integration ecosystem with pre-built connectors to popular business tools

- Strong security and compliance with PCI Level 1 certification and multiple standards

- AI-powered optimization features including Adaptive Acceptance and predictive analytics

Cons:

- Higher transaction fees compared to some traditional processors, especially for high-volume businesses

- No free plan; charges apply to all transactions processed through the platform

- Account holds and sudden suspensions can disrupt business operations without warning

- Limited phone support availability, primarily relies on email and chat assistance

- Complexity can be overwhelming for non-technical users requiring developer resources

- Payout delays can impact cash flow, especially for new accounts

- Geographic limitations with service not available in all countries globally

Who It's For

Stripe serves a diverse ecosystem of businesses across industries and sizes, making it one of the most versatile payment platforms available.

E-commerce and Online Retailers: Businesses selling products or services online benefit from Stripe's comprehensive payment acceptance, fraud protection, and global reach. The platform's checkout optimization and conversion tools help maximize revenue while supporting international expansion.

SaaS and Subscription Businesses: Software companies and subscription-based services leverage Stripe Billing for recurring revenue management, usage-based pricing, and customer lifecycle automation. The platform's flexibility supports complex billing scenarios and scaling subscription models.

Marketplaces and Platforms: Multi-sided platforms use Stripe Connect to facilitate payments between buyers and sellers while maintaining compliance and providing seamless money movement. This includes ride-sharing, food delivery, and service marketplaces.

AI and Technology Companies: Over 75% of Forbes AI 50 companies use Stripe to monetize their products, utilizing features like usage-based billing and AI agent payment capabilities. The platform supports emerging business models in the AI economy.

Enterprise Organizations: Large corporations benefit from Stripe's enterprise features including advanced security, compliance capabilities, dedicated support, and custom implementations. Companies like Amazon, Shopify, and Spotify rely on Stripe for critical payment infrastructure.

Startups and Small Businesses: Early-stage companies appreciate Stripe's ease of implementation, transparent pricing, and ability to scale without changing providers. The platform's pay-as-you-grow model aligns costs with business growth.

Payment Processing

Stripe's core payment processing engine supports over 100 payment methods including credit cards, debit cards, digital wallets, bank transfers, and local payment methods. The platform's direct connections to major card networks (Visa, Mastercard, American Express) optimize routing paths and reduce transaction latency while maximizing authorization rates.

The system employs machine learning to optimize every transaction through Adaptive Acceptance, which analyzes billions of data points to improve authorization rates in real-time. This technology helps businesses capture more revenue by reducing false declines and optimizing payment flows based on customer behavior patterns.

Stripe's global infrastructure ensures consistent performance across regions with built-in redundancy and automatic failover capabilities. The platform maintains 99.99%+ uptime while processing millions of transactions daily, making it suitable for mission-critical business operations.

Subscription Management

Stripe Billing provides comprehensive subscription and recurring billing capabilities that handle complex pricing models including tiered pricing, usage-based billing, and hybrid structures. The platform automates the entire subscription lifecycle from signup to renewal while providing tools for dunning management, proration, and customer communication.

Advanced features include smart retries for failed payments, automatic tax calculation, and customizable billing cycles. The system supports multiple pricing strategies including per-seat pricing, metered billing, and volume discounts, enabling businesses to experiment with revenue models and optimize monetization.

Customer self-service capabilities through the customer portal allow subscribers to manage their accounts, update payment methods, and modify subscriptions without requiring manual intervention. This reduces support burden while improving customer satisfaction and retention rates.

Fraud Prevention

Stripe Radar leverages machine learning trained on billions of transactions to provide real-time fraud detection and prevention. The system analyzes multiple risk factors including device fingerprinting, behavioral patterns, and transaction velocity to identify potentially fraudulent activities before they impact businesses.

The platform offers both automated fraud protection and customizable rules that allow businesses to define specific risk parameters based on their industry and risk tolerance. Advanced features include 3D Secure authentication, velocity checking, and geographic restrictions to provide layered security.

Radar's adaptive learning continuously improves fraud detection accuracy by analyzing new patterns and emerging threats. This proactive approach helps businesses minimize chargebacks while reducing false positives that could impact legitimate customers.

Developer Tools and APIs

Stripe's developer-centric approach provides comprehensive APIs, SDKs, and documentation that enable custom implementations and integrations. The platform supports multiple programming languages and frameworks with pre-built libraries that accelerate development and reduce implementation complexity.

Webhooks enable real-time event notifications, allowing businesses to build automated workflows that respond to payment events, subscription changes, and customer actions. The webhook system provides reliable delivery with automatic retry mechanisms and signature verification for security.

Stripe Elements offers pre-built UI components that provide secure payment forms while maintaining design flexibility. These components handle complex requirements like PCI compliance, input validation, and mobile optimization without requiring extensive security expertise.

Global Expansion

Stripe facilitates international business growth by supporting 135+ currencies and localized payment methods across 195+ countries. The platform handles complex regulatory requirements, tax compliance, and currency conversion while providing unified reporting and reconciliation.

Local payment method support includes region-specific options like SEPA, iDEAL, Alipay, and bank transfers that improve conversion rates in international markets. The platform's global infrastructure ensures consistent performance and compliance with local regulations.

Multi-currency capabilities include automatic currency conversion, local pricing presentation, and settlement in preferred currencies. This reduces complexity for international businesses while providing customers with familiar payment experiences.

Security and Compliance

Stripe maintains the highest security standards with PCI DSS Level 1 certification, SOC 2 compliance, and multiple international certifications. The platform employs advanced encryption, tokenization, and secure data handling practices that protect sensitive payment information throughout the transaction lifecycle.

Compliance features include automated regulatory reporting, tax calculation, and industry-specific requirements like HIPAA for healthcare organizations. The platform's security infrastructure is regularly audited and tested to ensure ongoing protection against emerging threats.

Enterprise security capabilities include SSO integration, IP restrictions, audit logging, and advanced access controls. These features enable large organizations to maintain security governance while providing appropriate access to team members.

Pricing

Stripe uses transparent, pay-as-you-go pricing with no setup fees, monthly fees, or long-term contracts. The standard pricing structure charges per successful transaction with clear, published rates that scale with business growth.

Standard Online Payments: 2.9% + $0.30 per successful transaction for credit cards, debit cards, and most digital wallets. This rate applies to domestic transactions in the United States.

In-Person Payments: 2.7% + $0.05 per transaction when using Stripe Terminal for card-present transactions, with reader hardware starting at $59.

International Payments: Additional 1.5% fee for international cards and currency conversion fees starting at 1% for multi-currency transactions.

ACH and Bank Transfers: ACH Direct Debit at 0.8% (capped at $5.00), ACH Credit at $1.00 flat fee, and wire transfers at $8.00 per transaction.

Premium Features: Additional costs for advanced features like Radar for fraud protection, Billing for subscription management, and Connect for marketplace functionality. Enterprise customers can access custom pricing and dedicated support.

Volume discounts and custom pricing are available for businesses with significant transaction volumes or specific requirements. The platform's transparent approach eliminates hidden fees while providing predictable cost structures.

Verdict

Stripe stands as the definitive payment infrastructure platform for businesses seeking comprehensive, scalable financial services. Its strength lies in combining powerful technical capabilities with business-friendly features that accommodate everything from simple payment acceptance to complex multi-sided marketplace operations.

The platform excels for technology-forward organizations that value developer experience, customization flexibility, and global reach. Stripe's continuous innovation in AI, fraud prevention, and emerging payment methods positions it well for future business needs, making it an excellent long-term strategic choice.

However, businesses should carefully consider Stripe's pricing structure, especially for high-volume operations where transaction fees can significantly impact margins. The platform's complexity may also require technical resources for optimal implementation and ongoing management.

For companies prioritizing reliability, security, and comprehensive functionality, Stripe represents excellent value despite premium pricing. The platform's extensive ecosystem, robust infrastructure, and commitment to innovation make it particularly suitable for businesses planning significant growth or international expansion.

The recent focus on AI capabilities, embedded finance, and next-generation payment experiences demonstrates Stripe's commitment to staying ahead of market trends while maintaining its core strength in payment processing excellence.

Frequently Asked Questions about Stripe

What is Stripe?

Stripe is the world's leading payment infrastructure platform that powers online commerce for millions of businesses globally. Founded in 2010 by Irish entrepreneurs Patrick and John Collison, Stripe has revolutionized digital payments by providing a comprehensive suite of APIs and tools that enable businesses to accept payments, manage subscriptions, send payouts, and handle complex financial operations seamlessly.

The platform serves as the financial backbone for companies ranging from early-stage startups to Fortune 500 enterprises, processing over $1 trillion in annual payment volume. Stripe's mission is to increase the GDP of the internet by providing the economic infrastructure that enables businesses to start, scale, and thrive in the digital economy.

What distinguishes Stripe from traditional payment processors is its developer-first approach and comprehensive platform architecture. Rather than simply processing credit card transactions, Stripe offers a complete financial operating system that includes payment processing, subscription billing, marketplace facilitation, fraud prevention, tax compliance, and banking services. This unified approach eliminates the need for businesses to integrate multiple vendors, reducing complexity and accelerating time to market.

Pros and Cons

Pros:

- Comprehensive payment infrastructure with 100+ payment methods and global reach to 195+ countries

- Developer-friendly APIs and extensive documentation with powerful customization capabilities

- Advanced fraud prevention through machine learning-powered Radar system

- Transparent pricing with no setup fees, monthly fees, or hidden costs

- Excellent uptime and reliability with enterprise-grade infrastructure

- Extensive integration ecosystem with pre-built connectors to popular business tools

- Strong security and compliance with PCI Level 1 certification and multiple standards

- AI-powered optimization features including Adaptive Acceptance and predictive analytics

Cons:

- Higher transaction fees compared to some traditional processors, especially for high-volume businesses

- No free plan; charges apply to all transactions processed through the platform

- Account holds and sudden suspensions can disrupt business operations without warning

- Limited phone support availability, primarily relies on email and chat assistance

- Complexity can be overwhelming for non-technical users requiring developer resources

- Payout delays can impact cash flow, especially for new accounts

- Geographic limitations with service not available in all countries globally

Who It's For

Stripe serves a diverse ecosystem of businesses across industries and sizes, making it one of the most versatile payment platforms available.

E-commerce and Online Retailers: Businesses selling products or services online benefit from Stripe's comprehensive payment acceptance, fraud protection, and global reach. The platform's checkout optimization and conversion tools help maximize revenue while supporting international expansion.

SaaS and Subscription Businesses: Software companies and subscription-based services leverage Stripe Billing for recurring revenue management, usage-based pricing, and customer lifecycle automation. The platform's flexibility supports complex billing scenarios and scaling subscription models.

Marketplaces and Platforms: Multi-sided platforms use Stripe Connect to facilitate payments between buyers and sellers while maintaining compliance and providing seamless money movement. This includes ride-sharing, food delivery, and service marketplaces.

AI and Technology Companies: Over 75% of Forbes AI 50 companies use Stripe to monetize their products, utilizing features like usage-based billing and AI agent payment capabilities. The platform supports emerging business models in the AI economy.

Enterprise Organizations: Large corporations benefit from Stripe's enterprise features including advanced security, compliance capabilities, dedicated support, and custom implementations. Companies like Amazon, Shopify, and Spotify rely on Stripe for critical payment infrastructure.

Startups and Small Businesses: Early-stage companies appreciate Stripe's ease of implementation, transparent pricing, and ability to scale without changing providers. The platform's pay-as-you-grow model aligns costs with business growth.

Payment Processing

Stripe's core payment processing engine supports over 100 payment methods including credit cards, debit cards, digital wallets, bank transfers, and local payment methods. The platform's direct connections to major card networks (Visa, Mastercard, American Express) optimize routing paths and reduce transaction latency while maximizing authorization rates.

The system employs machine learning to optimize every transaction through Adaptive Acceptance, which analyzes billions of data points to improve authorization rates in real-time. This technology helps businesses capture more revenue by reducing false declines and optimizing payment flows based on customer behavior patterns.

Stripe's global infrastructure ensures consistent performance across regions with built-in redundancy and automatic failover capabilities. The platform maintains 99.99%+ uptime while processing millions of transactions daily, making it suitable for mission-critical business operations.

Subscription Management

Stripe Billing provides comprehensive subscription and recurring billing capabilities that handle complex pricing models including tiered pricing, usage-based billing, and hybrid structures. The platform automates the entire subscription lifecycle from signup to renewal while providing tools for dunning management, proration, and customer communication.

Advanced features include smart retries for failed payments, automatic tax calculation, and customizable billing cycles. The system supports multiple pricing strategies including per-seat pricing, metered billing, and volume discounts, enabling businesses to experiment with revenue models and optimize monetization.

Customer self-service capabilities through the customer portal allow subscribers to manage their accounts, update payment methods, and modify subscriptions without requiring manual intervention. This reduces support burden while improving customer satisfaction and retention rates.

Fraud Prevention

Stripe Radar leverages machine learning trained on billions of transactions to provide real-time fraud detection and prevention. The system analyzes multiple risk factors including device fingerprinting, behavioral patterns, and transaction velocity to identify potentially fraudulent activities before they impact businesses.

The platform offers both automated fraud protection and customizable rules that allow businesses to define specific risk parameters based on their industry and risk tolerance. Advanced features include 3D Secure authentication, velocity checking, and geographic restrictions to provide layered security.

Radar's adaptive learning continuously improves fraud detection accuracy by analyzing new patterns and emerging threats. This proactive approach helps businesses minimize chargebacks while reducing false positives that could impact legitimate customers.

Developer Tools and APIs

Stripe's developer-centric approach provides comprehensive APIs, SDKs, and documentation that enable custom implementations and integrations. The platform supports multiple programming languages and frameworks with pre-built libraries that accelerate development and reduce implementation complexity.

Webhooks enable real-time event notifications, allowing businesses to build automated workflows that respond to payment events, subscription changes, and customer actions. The webhook system provides reliable delivery with automatic retry mechanisms and signature verification for security.

Stripe Elements offers pre-built UI components that provide secure payment forms while maintaining design flexibility. These components handle complex requirements like PCI compliance, input validation, and mobile optimization without requiring extensive security expertise.

Global Expansion

Stripe facilitates international business growth by supporting 135+ currencies and localized payment methods across 195+ countries. The platform handles complex regulatory requirements, tax compliance, and currency conversion while providing unified reporting and reconciliation.

Local payment method support includes region-specific options like SEPA, iDEAL, Alipay, and bank transfers that improve conversion rates in international markets. The platform's global infrastructure ensures consistent performance and compliance with local regulations.

Multi-currency capabilities include automatic currency conversion, local pricing presentation, and settlement in preferred currencies. This reduces complexity for international businesses while providing customers with familiar payment experiences.

Security and Compliance

Stripe maintains the highest security standards with PCI DSS Level 1 certification, SOC 2 compliance, and multiple international certifications. The platform employs advanced encryption, tokenization, and secure data handling practices that protect sensitive payment information throughout the transaction lifecycle.

Compliance features include automated regulatory reporting, tax calculation, and industry-specific requirements like HIPAA for healthcare organizations. The platform's security infrastructure is regularly audited and tested to ensure ongoing protection against emerging threats.

Enterprise security capabilities include SSO integration, IP restrictions, audit logging, and advanced access controls. These features enable large organizations to maintain security governance while providing appropriate access to team members.

Pricing

Stripe uses transparent, pay-as-you-go pricing with no setup fees, monthly fees, or long-term contracts. The standard pricing structure charges per successful transaction with clear, published rates that scale with business growth.

Standard Online Payments: 2.9% + $0.30 per successful transaction for credit cards, debit cards, and most digital wallets. This rate applies to domestic transactions in the United States.

In-Person Payments: 2.7% + $0.05 per transaction when using Stripe Terminal for card-present transactions, with reader hardware starting at $59.

International Payments: Additional 1.5% fee for international cards and currency conversion fees starting at 1% for multi-currency transactions.

ACH and Bank Transfers: ACH Direct Debit at 0.8% (capped at $5.00), ACH Credit at $1.00 flat fee, and wire transfers at $8.00 per transaction.

Premium Features: Additional costs for advanced features like Radar for fraud protection, Billing for subscription management, and Connect for marketplace functionality. Enterprise customers can access custom pricing and dedicated support.

Volume discounts and custom pricing are available for businesses with significant transaction volumes or specific requirements. The platform's transparent approach eliminates hidden fees while providing predictable cost structures.

Verdict

Stripe stands as the definitive payment infrastructure platform for businesses seeking comprehensive, scalable financial services. Its strength lies in combining powerful technical capabilities with business-friendly features that accommodate everything from simple payment acceptance to complex multi-sided marketplace operations.

The platform excels for technology-forward organizations that value developer experience, customization flexibility, and global reach. Stripe's continuous innovation in AI, fraud prevention, and emerging payment methods positions it well for future business needs, making it an excellent long-term strategic choice.

However, businesses should carefully consider Stripe's pricing structure, especially for high-volume operations where transaction fees can significantly impact margins. The platform's complexity may also require technical resources for optimal implementation and ongoing management.

For companies prioritizing reliability, security, and comprehensive functionality, Stripe represents excellent value despite premium pricing. The platform's extensive ecosystem, robust infrastructure, and commitment to innovation make it particularly suitable for businesses planning significant growth or international expansion.

The recent focus on AI capabilities, embedded finance, and next-generation payment experiences demonstrates Stripe's commitment to staying ahead of market trends while maintaining its core strength in payment processing excellence.