FreshBooks

FreshBooks

Streamline invoicing, expense tracking, time logging, and financial reporting with FreshBooks’ intuitive cloud accounting platform, designed for small businesses and freelancers (138 characters).

Key Features

- Invoicing

- Expense Tracking

- Time Tracking

- Estimates & Proposals

- Online Payments

- Recurring Invoices

- Automatic Payment Reminders

- Bank Reconciliation

- Project Management

- Financial Reporting

- Client Portal

What Is FreshBooks?

FreshBooks is a cloud-based accounting platform designed to simplify financial management for small businesses and freelancers. Launched in 2003, it combines invoicing, expense and time tracking, project collaboration, and robust reporting in an intuitive interface. With automated workflows and real-time data, FreshBooks reduces manual work and speeds up payments.

Pros and Cons

Pros

- Extremely user-friendly interface for non-accountants

- Automated invoicing workflows and payment reminders

- Built-in time tracking tied to invoices and projects

- Rich reporting suite including profit & loss and expense reports

- Mobile apps for iOS and Android enable on-the-go management

Cons

- No free forever tier; limited client count on entry plan

- Payroll is an add-on requiring separate setup and fees

- Advanced accounting features (e.g., double-entry) behind higher plans

- Lacks deeper inventory management compared to full ERP systems

Who It’s For

FreshBooks is ideal for:

- Freelancers & Consultants billing by the hour or project

- Creative Agencies tracking time, expenses, and client projects

- Small Service Businesses needing professional invoices and online payments

- Remote Teams collaborating on projects and budgets

- New Entrepreneurs requiring an easy-to-learn accounting tool

Invoicing

Create and send branded, customizable invoices. Set due dates, automated payment reminders, and accept credit card or ACH payments to accelerate cash flow.

Expense Tracking

Snap photos of receipts or import bank transactions to categorize and track expenses. Expenses link directly to projects and reports for clarity.

Time Tracking

Use built-in timers or manual entries to log billable hours. Associate time entries with clients, projects, or tasks, then convert directly into invoices.

Estimates & Proposals

Generate professional estimates and proposals. Once approved, convert estimates into invoices with a single click, preserving line items and terms.

Online Payments

Integrate with Stripe or PayPal to accept credit cards and ACH payments on invoices. Clients pay via a secure portal, reducing collection cycles.

Recurring Invoices & Reminders

Set recurring billing schedules for subscriptions or retainer clients. Customize and automate payment reminders and late fees to ensure timely payments.

Bank Reconciliation

Sync bank and credit card accounts automatically. Match imported transactions to invoices or expenses and reconcile statements quickly.

Project Management

Create and manage projects, assign tasks, set budgets, and collaborate with team members. Track time and expenses alongside project progress.

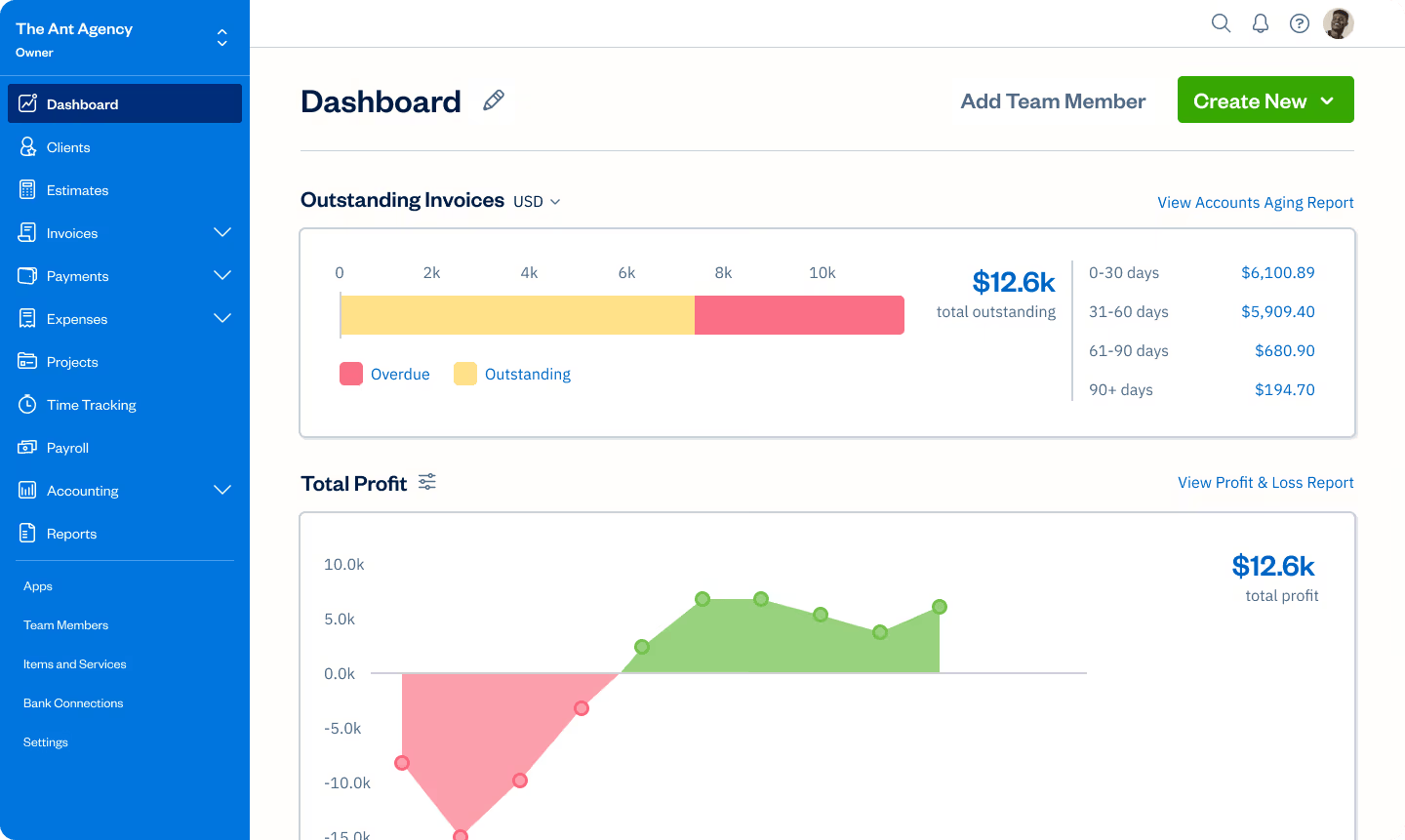

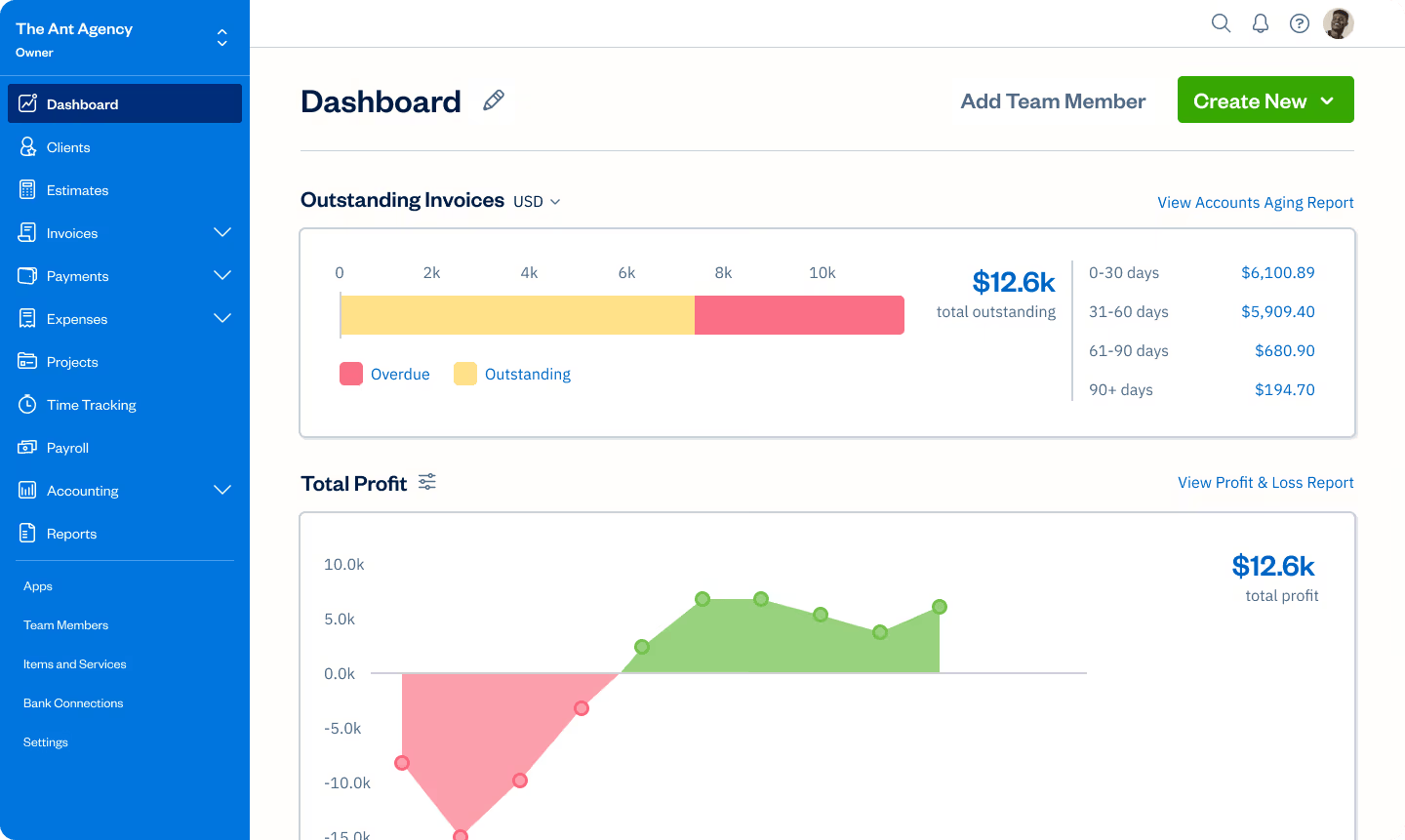

Financial Reporting

Access real-time reports such as profit & loss, expense details, tax summaries, and receivables aging. Export to CSV or PDF for accountants and stakeholders.

Client Portal

Clients access a dedicated portal to view invoices, payment history, and project details. Encourage on-time payments with self-service billing features.

Mobile App

FreshBooks mobile apps for iOS and Android let you send invoices, log expenses, and track time from anywhere, keeping your business moving on the go.

Pricing

FreshBooks offers four plans (billed monthly; annual billing saves 10%):

- Lite – $21/mo: Up to 5 billable clients; unlimited invoices, expenses, and time tracking; payment reminders.

- Plus – $38/mo: Up to 50 clients; includes financial reports and proposals; accountant collaboration.

- Premium – $65/mo: Unlimited clients; team member accounts; project profitability tracking.

- Select – Custom pricing: Enterprise features including dedicated support, custom onboarding, and lower transaction rates.

30-day free trial available on all plans; limited-time promotions offer up to 70% off initial months.

Verdict

FreshBooks stands out for its ease of use and comprehensive feature set tailored to small-scale professional service providers. Its seamless invoicing, powerful automation, and mobile accessibility make it an excellent choice for freelancers and small businesses seeking fast deployment without heavy accounting complexity. Larger teams or enterprises requiring advanced finance modules may consider higher-tier plans or complementary tools.

Frequently Asked Questions about FreshBooks

What Is FreshBooks?

FreshBooks is a cloud-based accounting platform designed to simplify financial management for small businesses and freelancers. Launched in 2003, it combines invoicing, expense and time tracking, project collaboration, and robust reporting in an intuitive interface. With automated workflows and real-time data, FreshBooks reduces manual work and speeds up payments.

Pros and Cons

Pros

- Extremely user-friendly interface for non-accountants

- Automated invoicing workflows and payment reminders

- Built-in time tracking tied to invoices and projects

- Rich reporting suite including profit & loss and expense reports

- Mobile apps for iOS and Android enable on-the-go management

Cons

- No free forever tier; limited client count on entry plan

- Payroll is an add-on requiring separate setup and fees

- Advanced accounting features (e.g., double-entry) behind higher plans

- Lacks deeper inventory management compared to full ERP systems

Who It’s For

FreshBooks is ideal for:

- Freelancers & Consultants billing by the hour or project

- Creative Agencies tracking time, expenses, and client projects

- Small Service Businesses needing professional invoices and online payments

- Remote Teams collaborating on projects and budgets

- New Entrepreneurs requiring an easy-to-learn accounting tool

Invoicing

Create and send branded, customizable invoices. Set due dates, automated payment reminders, and accept credit card or ACH payments to accelerate cash flow.

Expense Tracking

Snap photos of receipts or import bank transactions to categorize and track expenses. Expenses link directly to projects and reports for clarity.

Time Tracking

Use built-in timers or manual entries to log billable hours. Associate time entries with clients, projects, or tasks, then convert directly into invoices.

Estimates & Proposals

Generate professional estimates and proposals. Once approved, convert estimates into invoices with a single click, preserving line items and terms.

Online Payments

Integrate with Stripe or PayPal to accept credit cards and ACH payments on invoices. Clients pay via a secure portal, reducing collection cycles.

Recurring Invoices & Reminders

Set recurring billing schedules for subscriptions or retainer clients. Customize and automate payment reminders and late fees to ensure timely payments.

Bank Reconciliation

Sync bank and credit card accounts automatically. Match imported transactions to invoices or expenses and reconcile statements quickly.

Project Management

Create and manage projects, assign tasks, set budgets, and collaborate with team members. Track time and expenses alongside project progress.

Financial Reporting

Access real-time reports such as profit & loss, expense details, tax summaries, and receivables aging. Export to CSV or PDF for accountants and stakeholders.

Client Portal

Clients access a dedicated portal to view invoices, payment history, and project details. Encourage on-time payments with self-service billing features.

Mobile App

FreshBooks mobile apps for iOS and Android let you send invoices, log expenses, and track time from anywhere, keeping your business moving on the go.

Pricing

FreshBooks offers four plans (billed monthly; annual billing saves 10%):

- Lite – $21/mo: Up to 5 billable clients; unlimited invoices, expenses, and time tracking; payment reminders.

- Plus – $38/mo: Up to 50 clients; includes financial reports and proposals; accountant collaboration.

- Premium – $65/mo: Unlimited clients; team member accounts; project profitability tracking.

- Select – Custom pricing: Enterprise features including dedicated support, custom onboarding, and lower transaction rates.

30-day free trial available on all plans; limited-time promotions offer up to 70% off initial months.

Verdict

FreshBooks stands out for its ease of use and comprehensive feature set tailored to small-scale professional service providers. Its seamless invoicing, powerful automation, and mobile accessibility make it an excellent choice for freelancers and small businesses seeking fast deployment without heavy accounting complexity. Larger teams or enterprises requiring advanced finance modules may consider higher-tier plans or complementary tools.