QuickBooks

QuickBooks

Comprehensive accounting software offering invoicing, expense tracking, payroll, inventory management, and financial reporting for businesses of all sizes.

Key Features

- Financial Management & Accounting

- Invoicing & Billing

- Expense Tracking

- Bank Account Integration

- Accounts Receivable Management

- Accounts Payable Management

- Payroll Processing

- Tax Preparation & Filing

- Inventory Management

- Project & Job Tracking

- Time Tracking

- Reporting & Analytics

- Dashboard & Insights

- Multi-Currency Support

- Receipt Capture

- Budgeting & Forecasting

- Cash Flow Management

- Estimate Creation

- Purchase Order Management

- Vendor Management

- Customer Management

- Sales Tax Calculation

- Audit Trail

- Document Management

- Real-Time Collaboration

- Automated Data Backup

- Multi-User Access

- Custom Fields

- Workflow Automation

- AI-Powered Insights

- Bank Reconciliation

- Check Printing

- Direct Deposit

What is QuickBooks?

QuickBooks is the world's leading accounting software platform developed by Intuit, serving over 7 million small and medium-sized businesses globally. Since its launch in 1992, QuickBooks has evolved from a simple bookkeeping tool into a comprehensive financial management ecosystem that dominates the accounting software market with a commanding 62.23% market share.

The platform is available in two primary versions: QuickBooks Online, a cloud-based solution that emphasizes accessibility and real-time collaboration, and QuickBooks Desktop, which provides advanced features for complex accounting needs. QuickBooks Online has become the flagship product, generating $8 billion in revenue as of 2023, reflecting the industry's shift toward cloud-based solutions.

What sets QuickBooks apart is its ability to serve businesses across the entire growth spectrum, from solo entrepreneurs to enterprises with thousands of employees. The platform's strength lies in its intuitive interface that makes professional accounting accessible to users without formal accounting training, while still providing the depth and functionality required by accounting professionals and growing businesses.

QuickBooks operates on a philosophy of simplifying complex financial tasks through automation, intelligent categorization, and seamless integrations with over 750 third-party applications. This comprehensive approach has made it the go-to choice for 80% of small businesses in the United States, with particularly strong adoption in industries like construction (17.22%), accounting (13.40%), and information technology (12.50%).

Pros and Cons

Pros:

- Industry-leading market position with 62.23% market share and extensive user base

- Comprehensive feature set covering all aspects of financial management from invoicing to tax preparation

- User-friendly interface designed for non-accountants with minimal learning curve

- Extensive integration ecosystem with 750+ apps and robust API access

- Strong automation capabilities reducing manual data entry and errors

- Excellent mobile apps for iOS and Android with full feature parity

- AI-powered insights and smart categorization for enhanced productivity

- Reliable cloud infrastructure with automatic updates and data backup

- Comprehensive customer support with multiple contact channels

- Scalable pricing tiers accommodating businesses from startups to enterprises

Cons:

- Higher pricing compared to basic accounting software, especially for advanced features

- Steep learning curve for complex features and advanced customizations

- Limited offline functionality requiring internet connectivity for most operations

- Customer support quality inconsistency with mixed user experiences

- Account limitations and usage restrictions on lower-tier plans

- No free plan available; all plans require monthly subscription fees

- Desktop version being discontinued for new users, forcing cloud migration

- Some advanced features require higher-tier plans or add-on purchases

Who It's For

QuickBooks serves a diverse ecosystem spanning multiple business sizes, industries, and use cases, making it one of the most versatile accounting platforms available.

Small Businesses (1-50 employees): QuickBooks is particularly popular with small businesses, with 62% of users having fewer than 50 employees. These businesses benefit from professional accounting capabilities without enterprise complexity, including automated invoicing, expense tracking, and basic reporting that streamlines financial management.

Construction and Service Industries: Construction companies represent the largest user segment at 17.22% of QuickBooks users. The platform's job costing features, project tracking, and progress billing capabilities make it ideal for project-based businesses that need to track profitability by job or client.

Accounting Professionals: With 13.40% of users in the accounting industry, QuickBooks serves as the standard platform for bookkeepers and accounting firms managing multiple client books. The software's multi-user capabilities and accountant-specific features facilitate professional service delivery.

Technology and Healthcare Organizations: IT services (12.50%) and healthcare (8.97%) represent significant user segments, leveraging QuickBooks for service billing, compliance reporting, and financial management in regulated environments.

Startups and Entrepreneurs: Early-stage businesses appreciate QuickBooks' scalability and professional features that grow with the organization. The platform's integration capabilities and automated features help founders focus on core business activities rather than administrative tasks.

Established SMBs and Mid-Market Companies: Businesses with revenues between $1-50 million represent 67.76% of QuickBooks users, indicating the platform's strength in serving growing organizations that need sophisticated financial management without enterprise software complexity.

Financial Management & Accounting

QuickBooks provides comprehensive double-entry accounting capabilities that maintain accurate financial records while remaining accessible to non-accountants. The platform automatically handles complex accounting principles like debits, credits, and account balancing, ensuring compliance with Generally Accepted Accounting Principles (GAAP).

The chart of accounts can be customized to match specific business needs, with unlimited accounts available on higher-tier plans. Users can create custom account types, track multiple currencies, and manage complex organizational structures through classes and locations. The system maintains complete audit trails for all transactions, providing transparency and supporting compliance requirements.

Advanced features include automated journal entries, period-end closing procedures, and adjusting entries that ensure accurate financial reporting. The platform's AI capabilities assist with transaction categorization and duplicate detection, reducing manual errors while maintaining accounting accuracy.

Invoicing & Billing

QuickBooks' invoicing system delivers professional-grade billing capabilities with extensive customization options and payment processing integration. Users can create branded invoices with company logos, custom fields, and personalized messaging that reflects their business identity.

The platform supports multiple invoice types including standard invoices, recurring billing, progress invoicing for project-based work, and estimate-to-invoice conversion. Automated features include payment reminders, late fee calculations, and recurring invoice generation that reduces administrative overhead.

Payment processing integration allows customers to pay directly through invoices via credit cards, ACH transfers, Apple Pay, and other popular payment methods. The system tracks payment status in real-time and automatically updates accounts receivable when payments are received.

Expense Tracking

Comprehensive expense management features help businesses track, categorize, and report all business expenditures accurately. The mobile app includes receipt capture functionality that uses optical character recognition (OCR) to extract key information and automatically create expense entries.

Mileage tracking with GPS integration simplifies travel expense reporting for businesses with mobile workers or frequent travel requirements. The system can automatically calculate reimbursable amounts based on IRS rates and generate detailed mileage reports for tax purposes.

Expense categorization benefits from AI-powered suggestions that learn from historical data to improve accuracy over time. Users can create custom expense categories, assign expenses to specific projects or customers, and track billable expenses for client reimbursement.

Bank Account Integration

Real-time bank feed connectivity automatically downloads and categorizes transactions from connected financial institutions, dramatically reducing manual data entry. The system supports connections to over 14,000 financial institutions worldwide, ensuring broad compatibility.

Bank reconciliation features provide guided matching of downloaded transactions with recorded entries, highlighting discrepancies and suggesting corrections. Automated reconciliation rules can be configured for recurring transactions, further streamlining the monthly reconciliation process.

Cash flow management tools provide real-time visibility into account balances, pending transactions, and projected cash flow based on outstanding invoices and bills. This enables proactive financial planning and helps prevent cash flow problems.

Accounts Receivable Management

Sophisticated accounts receivable functionality tracks customer balances, payment history, and aging reports that identify overdue accounts. The A/R aging summary and detail reports provide clear visibility into outstanding customer balances categorized by aging periods (current, 1-30 days, 31-60 days, etc.).

Automated collection features include payment reminder emails, late fee calculations, and collection letter generation that helps improve cash flow without manual intervention. Customer payment portals enable self-service access to invoices and payment options, improving customer satisfaction while reducing administrative costs.

Credit management tools allow businesses to set customer credit limits, track payment terms, and flag accounts that exceed established thresholds. Integration with credit reporting agencies provides additional insights for credit decision-making.

Payroll Processing

Full-service payroll capabilities handle employee compensation, tax calculations, and compliance reporting through integrated or add-on services. The system supports multiple pay schedules, direct deposit, printed checks, and comprehensive tax filing services.

Employee self-service portals provide access to pay stubs, tax documents, and personal information management, reducing HR administrative burden. Time tracking integration enables accurate payroll processing based on actual hours worked, with support for overtime calculations and multiple pay rates.

Tax compliance features automatically calculate federal, state, and local taxes while handling tax form preparation and filing. Year-end processing includes automated W-2 and 1099 generation, ensuring compliance with tax reporting requirements.

Inventory Management

Built-in inventory tracking maintains real-time visibility into stock levels, product costs, and reorder points. The system automatically adjusts inventory quantities based on sales and purchase transactions, providing accurate inventory valuations for financial reporting.

Low stock alerts and reorder point management help prevent stockouts while avoiding excess inventory carrying costs. Integration with e-commerce platforms like Shopify, Amazon, and eBay enables multi-channel inventory management from a single system.

Advanced inventory features include barcode scanning, lot tracking, and assembly management for businesses that manufacture or assemble products. Cost accounting methods including FIFO, LIFO, and average costing provide flexibility for different business models and tax strategies.

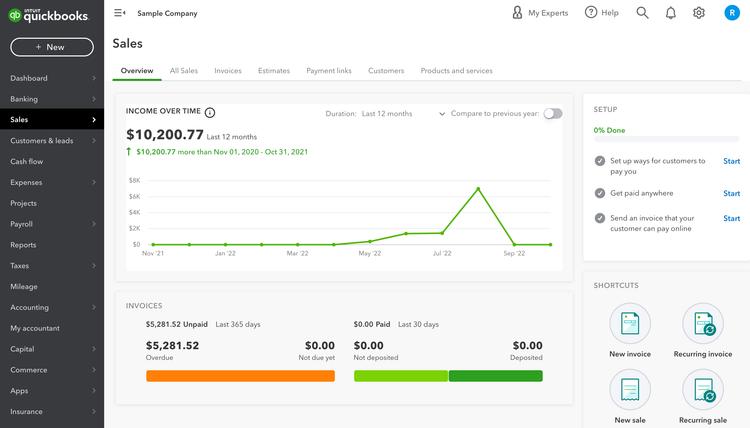

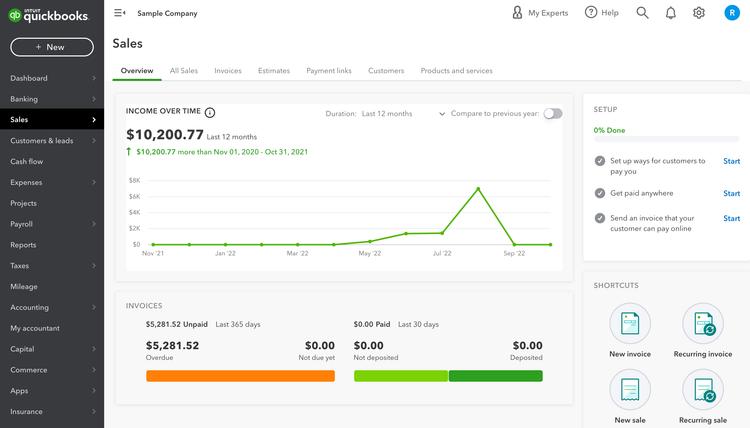

Reporting & Analytics

Comprehensive reporting capabilities provide insights into business performance through over 65 standard reports covering financial statements, management reports, and industry-specific analytics. Real-time dashboards display key performance indicators and financial metrics that enable data-driven decision making.

AI-powered insights analyze business trends, identify opportunities, and provide recommendations for improving financial performance. Predictive analytics help forecast cash flow, sales trends, and seasonal patterns that support strategic planning.

Custom report building allows users to create tailored reports that meet specific business requirements. Reports can be scheduled for automatic generation and distribution, ensuring stakeholders receive timely financial information without manual intervention.

Mobile Applications

Full-featured mobile apps for iOS and Android provide complete access to QuickBooks functionality from smartphones and tablets. The mobile experience includes unique capabilities like receipt scanning, mileage tracking with GPS, and voice note recording for quick transaction entry.

Offline functionality allows users to continue working when internet connectivity is limited, with automatic synchronization when connection is restored. Push notifications keep users informed about important events like payment receipts, low inventory levels, and overdue invoices.

Mobile-specific features include barcode scanning for inventory management, location-based expense tracking, and photo capture for documentation. These capabilities make QuickBooks particularly effective for field-based businesses and remote workers.

Pricing

QuickBooks offers transparent subscription pricing across multiple tiers designed to accommodate different business sizes and feature requirements.

QuickBooks Online:

- Simple Start: $35 per month (annual billing) - Supports 1 user with basic income and expense tracking, invoice creation, receipt capture, and mileage tracking

- Essentials: $65 per month (annual billing) - Includes 3 users, bill management, time tracking, and multiple currency support

- Plus: $99 per month (annual billing) - Supports 5 users with inventory tracking, project profitability, budgeting, and 1099 contractor management

- Advanced: $235 per month (annual billing) - Includes 25 users, advanced reporting, batch invoicing, custom fields, and priority support

QuickBooks Desktop:

- Pro Plus: $549.99 per year - Single-user desktop version with advanced features for small businesses

- Premier Plus: $799.99 per year - Industry-specific versions with specialized features

- Enterprise: Custom pricing starting around $1,340 per year - Advanced features for larger organizations with complex needs

Add-On Services:

- QuickBooks Payroll: Starting at $50 per month plus $5 per employee

- QuickBooks Payments: 2.9% + $0.25 per transaction for online payments

- QuickBooks Time: $10 per user per month for advanced time tracking

All plans include customer support, automatic updates, and integration access. Educational institutions and nonprofits receive discounts on standard pricing.

Verdict

QuickBooks stands as the undisputed leader in small business accounting software, offering an unmatched combination of functionality, ease of use, and market reach. Its dominance stems from successfully democratizing professional accounting capabilities, making sophisticated financial management accessible to business owners without formal accounting training.

The platform's greatest strength lies in its comprehensive approach to business financial management. Rather than simply tracking transactions, QuickBooks provides a complete ecosystem that handles everything from initial client contact through final payment and tax reporting. This integrated approach eliminates the need for multiple software solutions while ensuring data consistency across all business processes.

However, QuickBooks' market position comes with certain trade-offs. The platform's pricing has increased significantly over time, making it less accessible for very small businesses or those with tight budgets. Additionally, the forced migration from Desktop to Online versions may not suit all businesses, particularly those with complex, industry-specific requirements.

For most small to medium-sized businesses, QuickBooks represents an excellent investment in long-term financial management capabilities. The platform's continuous innovation, extensive integration ecosystem, and proven scalability make it particularly valuable for growing organizations that need accounting software capable of evolving with their needs.

The recent emphasis on AI-powered features and automation positions QuickBooks well for the future of business financial management, though businesses should carefully evaluate whether the advanced features justify the premium pricing compared to more basic alternatives.

Frequently Asked Questions about QuickBooks

What is QuickBooks?

QuickBooks is the world's leading accounting software platform developed by Intuit, serving over 7 million small and medium-sized businesses globally. Since its launch in 1992, QuickBooks has evolved from a simple bookkeeping tool into a comprehensive financial management ecosystem that dominates the accounting software market with a commanding 62.23% market share.

The platform is available in two primary versions: QuickBooks Online, a cloud-based solution that emphasizes accessibility and real-time collaboration, and QuickBooks Desktop, which provides advanced features for complex accounting needs. QuickBooks Online has become the flagship product, generating $8 billion in revenue as of 2023, reflecting the industry's shift toward cloud-based solutions.

What sets QuickBooks apart is its ability to serve businesses across the entire growth spectrum, from solo entrepreneurs to enterprises with thousands of employees. The platform's strength lies in its intuitive interface that makes professional accounting accessible to users without formal accounting training, while still providing the depth and functionality required by accounting professionals and growing businesses.

QuickBooks operates on a philosophy of simplifying complex financial tasks through automation, intelligent categorization, and seamless integrations with over 750 third-party applications. This comprehensive approach has made it the go-to choice for 80% of small businesses in the United States, with particularly strong adoption in industries like construction (17.22%), accounting (13.40%), and information technology (12.50%).

Pros and Cons

Pros:

- Industry-leading market position with 62.23% market share and extensive user base

- Comprehensive feature set covering all aspects of financial management from invoicing to tax preparation

- User-friendly interface designed for non-accountants with minimal learning curve

- Extensive integration ecosystem with 750+ apps and robust API access

- Strong automation capabilities reducing manual data entry and errors

- Excellent mobile apps for iOS and Android with full feature parity

- AI-powered insights and smart categorization for enhanced productivity

- Reliable cloud infrastructure with automatic updates and data backup

- Comprehensive customer support with multiple contact channels

- Scalable pricing tiers accommodating businesses from startups to enterprises

Cons:

- Higher pricing compared to basic accounting software, especially for advanced features

- Steep learning curve for complex features and advanced customizations

- Limited offline functionality requiring internet connectivity for most operations

- Customer support quality inconsistency with mixed user experiences

- Account limitations and usage restrictions on lower-tier plans

- No free plan available; all plans require monthly subscription fees

- Desktop version being discontinued for new users, forcing cloud migration

- Some advanced features require higher-tier plans or add-on purchases

Who It's For

QuickBooks serves a diverse ecosystem spanning multiple business sizes, industries, and use cases, making it one of the most versatile accounting platforms available.

Small Businesses (1-50 employees): QuickBooks is particularly popular with small businesses, with 62% of users having fewer than 50 employees. These businesses benefit from professional accounting capabilities without enterprise complexity, including automated invoicing, expense tracking, and basic reporting that streamlines financial management.

Construction and Service Industries: Construction companies represent the largest user segment at 17.22% of QuickBooks users. The platform's job costing features, project tracking, and progress billing capabilities make it ideal for project-based businesses that need to track profitability by job or client.

Accounting Professionals: With 13.40% of users in the accounting industry, QuickBooks serves as the standard platform for bookkeepers and accounting firms managing multiple client books. The software's multi-user capabilities and accountant-specific features facilitate professional service delivery.

Technology and Healthcare Organizations: IT services (12.50%) and healthcare (8.97%) represent significant user segments, leveraging QuickBooks for service billing, compliance reporting, and financial management in regulated environments.

Startups and Entrepreneurs: Early-stage businesses appreciate QuickBooks' scalability and professional features that grow with the organization. The platform's integration capabilities and automated features help founders focus on core business activities rather than administrative tasks.

Established SMBs and Mid-Market Companies: Businesses with revenues between $1-50 million represent 67.76% of QuickBooks users, indicating the platform's strength in serving growing organizations that need sophisticated financial management without enterprise software complexity.

Financial Management & Accounting

QuickBooks provides comprehensive double-entry accounting capabilities that maintain accurate financial records while remaining accessible to non-accountants. The platform automatically handles complex accounting principles like debits, credits, and account balancing, ensuring compliance with Generally Accepted Accounting Principles (GAAP).

The chart of accounts can be customized to match specific business needs, with unlimited accounts available on higher-tier plans. Users can create custom account types, track multiple currencies, and manage complex organizational structures through classes and locations. The system maintains complete audit trails for all transactions, providing transparency and supporting compliance requirements.

Advanced features include automated journal entries, period-end closing procedures, and adjusting entries that ensure accurate financial reporting. The platform's AI capabilities assist with transaction categorization and duplicate detection, reducing manual errors while maintaining accounting accuracy.

Invoicing & Billing

QuickBooks' invoicing system delivers professional-grade billing capabilities with extensive customization options and payment processing integration. Users can create branded invoices with company logos, custom fields, and personalized messaging that reflects their business identity.

The platform supports multiple invoice types including standard invoices, recurring billing, progress invoicing for project-based work, and estimate-to-invoice conversion. Automated features include payment reminders, late fee calculations, and recurring invoice generation that reduces administrative overhead.

Payment processing integration allows customers to pay directly through invoices via credit cards, ACH transfers, Apple Pay, and other popular payment methods. The system tracks payment status in real-time and automatically updates accounts receivable when payments are received.

Expense Tracking

Comprehensive expense management features help businesses track, categorize, and report all business expenditures accurately. The mobile app includes receipt capture functionality that uses optical character recognition (OCR) to extract key information and automatically create expense entries.

Mileage tracking with GPS integration simplifies travel expense reporting for businesses with mobile workers or frequent travel requirements. The system can automatically calculate reimbursable amounts based on IRS rates and generate detailed mileage reports for tax purposes.

Expense categorization benefits from AI-powered suggestions that learn from historical data to improve accuracy over time. Users can create custom expense categories, assign expenses to specific projects or customers, and track billable expenses for client reimbursement.

Bank Account Integration

Real-time bank feed connectivity automatically downloads and categorizes transactions from connected financial institutions, dramatically reducing manual data entry. The system supports connections to over 14,000 financial institutions worldwide, ensuring broad compatibility.

Bank reconciliation features provide guided matching of downloaded transactions with recorded entries, highlighting discrepancies and suggesting corrections. Automated reconciliation rules can be configured for recurring transactions, further streamlining the monthly reconciliation process.

Cash flow management tools provide real-time visibility into account balances, pending transactions, and projected cash flow based on outstanding invoices and bills. This enables proactive financial planning and helps prevent cash flow problems.

Accounts Receivable Management

Sophisticated accounts receivable functionality tracks customer balances, payment history, and aging reports that identify overdue accounts. The A/R aging summary and detail reports provide clear visibility into outstanding customer balances categorized by aging periods (current, 1-30 days, 31-60 days, etc.).

Automated collection features include payment reminder emails, late fee calculations, and collection letter generation that helps improve cash flow without manual intervention. Customer payment portals enable self-service access to invoices and payment options, improving customer satisfaction while reducing administrative costs.

Credit management tools allow businesses to set customer credit limits, track payment terms, and flag accounts that exceed established thresholds. Integration with credit reporting agencies provides additional insights for credit decision-making.

Payroll Processing

Full-service payroll capabilities handle employee compensation, tax calculations, and compliance reporting through integrated or add-on services. The system supports multiple pay schedules, direct deposit, printed checks, and comprehensive tax filing services.

Employee self-service portals provide access to pay stubs, tax documents, and personal information management, reducing HR administrative burden. Time tracking integration enables accurate payroll processing based on actual hours worked, with support for overtime calculations and multiple pay rates.

Tax compliance features automatically calculate federal, state, and local taxes while handling tax form preparation and filing. Year-end processing includes automated W-2 and 1099 generation, ensuring compliance with tax reporting requirements.

Inventory Management

Built-in inventory tracking maintains real-time visibility into stock levels, product costs, and reorder points. The system automatically adjusts inventory quantities based on sales and purchase transactions, providing accurate inventory valuations for financial reporting.

Low stock alerts and reorder point management help prevent stockouts while avoiding excess inventory carrying costs. Integration with e-commerce platforms like Shopify, Amazon, and eBay enables multi-channel inventory management from a single system.

Advanced inventory features include barcode scanning, lot tracking, and assembly management for businesses that manufacture or assemble products. Cost accounting methods including FIFO, LIFO, and average costing provide flexibility for different business models and tax strategies.

Reporting & Analytics

Comprehensive reporting capabilities provide insights into business performance through over 65 standard reports covering financial statements, management reports, and industry-specific analytics. Real-time dashboards display key performance indicators and financial metrics that enable data-driven decision making.

AI-powered insights analyze business trends, identify opportunities, and provide recommendations for improving financial performance. Predictive analytics help forecast cash flow, sales trends, and seasonal patterns that support strategic planning.

Custom report building allows users to create tailored reports that meet specific business requirements. Reports can be scheduled for automatic generation and distribution, ensuring stakeholders receive timely financial information without manual intervention.

Mobile Applications

Full-featured mobile apps for iOS and Android provide complete access to QuickBooks functionality from smartphones and tablets. The mobile experience includes unique capabilities like receipt scanning, mileage tracking with GPS, and voice note recording for quick transaction entry.

Offline functionality allows users to continue working when internet connectivity is limited, with automatic synchronization when connection is restored. Push notifications keep users informed about important events like payment receipts, low inventory levels, and overdue invoices.

Mobile-specific features include barcode scanning for inventory management, location-based expense tracking, and photo capture for documentation. These capabilities make QuickBooks particularly effective for field-based businesses and remote workers.

Pricing

QuickBooks offers transparent subscription pricing across multiple tiers designed to accommodate different business sizes and feature requirements.

QuickBooks Online:

- Simple Start: $35 per month (annual billing) - Supports 1 user with basic income and expense tracking, invoice creation, receipt capture, and mileage tracking

- Essentials: $65 per month (annual billing) - Includes 3 users, bill management, time tracking, and multiple currency support

- Plus: $99 per month (annual billing) - Supports 5 users with inventory tracking, project profitability, budgeting, and 1099 contractor management

- Advanced: $235 per month (annual billing) - Includes 25 users, advanced reporting, batch invoicing, custom fields, and priority support

QuickBooks Desktop:

- Pro Plus: $549.99 per year - Single-user desktop version with advanced features for small businesses

- Premier Plus: $799.99 per year - Industry-specific versions with specialized features

- Enterprise: Custom pricing starting around $1,340 per year - Advanced features for larger organizations with complex needs

Add-On Services:

- QuickBooks Payroll: Starting at $50 per month plus $5 per employee

- QuickBooks Payments: 2.9% + $0.25 per transaction for online payments

- QuickBooks Time: $10 per user per month for advanced time tracking

All plans include customer support, automatic updates, and integration access. Educational institutions and nonprofits receive discounts on standard pricing.

Verdict

QuickBooks stands as the undisputed leader in small business accounting software, offering an unmatched combination of functionality, ease of use, and market reach. Its dominance stems from successfully democratizing professional accounting capabilities, making sophisticated financial management accessible to business owners without formal accounting training.

The platform's greatest strength lies in its comprehensive approach to business financial management. Rather than simply tracking transactions, QuickBooks provides a complete ecosystem that handles everything from initial client contact through final payment and tax reporting. This integrated approach eliminates the need for multiple software solutions while ensuring data consistency across all business processes.

However, QuickBooks' market position comes with certain trade-offs. The platform's pricing has increased significantly over time, making it less accessible for very small businesses or those with tight budgets. Additionally, the forced migration from Desktop to Online versions may not suit all businesses, particularly those with complex, industry-specific requirements.

For most small to medium-sized businesses, QuickBooks represents an excellent investment in long-term financial management capabilities. The platform's continuous innovation, extensive integration ecosystem, and proven scalability make it particularly valuable for growing organizations that need accounting software capable of evolving with their needs.

The recent emphasis on AI-powered features and automation positions QuickBooks well for the future of business financial management, though businesses should carefully evaluate whether the advanced features justify the premium pricing compared to more basic alternatives.